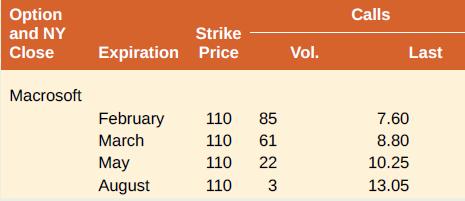

Question: Use the option quote information shown here to answer the questions that follow. The stock is currently selling for $83. a. Are the call options

Use the option quote information shown here to answer the questions that follow. The stock is currently selling for $83.

a. Are the call options in the money? What is the intrinsic value of an RWJ Corp. call option?

b. Are the put options in the money? What is the intrinsic value of an RWJ Corp. put option?

c. Two of the options are clearly mispriced. Which ones? At a minimum, what should the mispriced options sell for? Explain how you could profit from the mispricing in each case.

Option and NY Calls Strike Expiration Price Close Vol. Last Macrosoft February 110 85 7.60 March 110 61 8.80 ay August 110 22 10.25 110 3 13.05

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

a The calls are in the money The intrinsic value of the calls is 3 b The put... View full answer

Get step-by-step solutions from verified subject matter experts