You are the financial analyst for a tennis racket manufacturer. The company is considering using a graphitelike

Question:

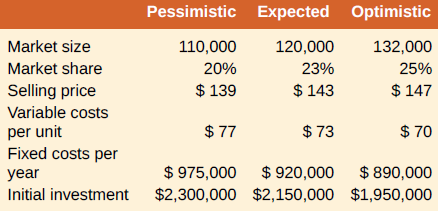

You are the financial analyst for a tennis racket manufacturer. The company is considering using a graphitelike material in its tennis rackets. The company has estimated the information in the following table about the market for a racket with the new material. The company expects to sell the racket for six years. The equipment required for the project will be depreciated on a straight-line basis and has no salvage value. The required return for projects of this type is 13 percent and the company has a 21 percent tax rate. Should you recommend the project?

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance

ISBN: 978-1259918940

12th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted: