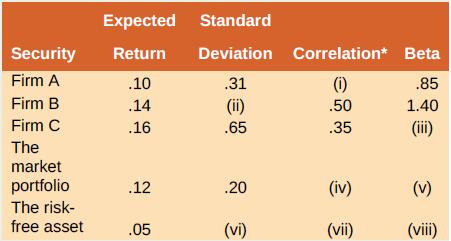

You have been provided the following data about the securities of three firms, the market portfolio, and

Question:

You have been provided the following data about the securities of three firms, the market portfolio, and the riskfree asset:

a. Fill in the missing values in the table.

b. Is the stock of Firm A correctly priced according to the capital asset pricing model (CAPM)? What about the stock of Firm B? Firm C? If these securities are not correctly priced, what is your investment recommendation for someone with a well-diversified portfolio?

Capital Asset Pricing ModelThe Capital Asset Pricing Model (CAPM) describes the relationship between systematic risk and expected return for assets, particularly stocks. The CAPM is a model for pricing an individual security or portfolio. For individual securities, we make use of the security market line (SML) and its...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance

ISBN: 978-1259918940

12th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted: