Carrie DLake, Reed A. Green, and Doug A. Divot share a passion for golf and decide to

Question:

Partner............................Contribution

Carrie D€™Lake..................Land, FMV $460,000

.........................................Basis $460,000, Mortgage $60,000

Reed A. Green................$400,000

Doug A. Divot.................$400,000

Carrie had recently acquired the land with the idea that she would contribute it to the newly formed partnership. The partners agree to share in profits and losses equally. Slicenhook elects a calendar year-end and the accrual method of accounting.

In addition, Slicenhook received a $1,500,000 recourse loan from Big Bank at the time the contributions were made. Slicenhook uses the proceeds from the loan and the cash contributions to build a state-of-the-art manufacturing facility ($1,200,000), purchase equipment ($600,000), and produce inventory ($400,000). With the remaining cash, Slicenhook invests $45,000 in the stock of a privately owned graphite research company and retains $55,000 as working cash.

Slicenhook operates on a just-in-time inventory system so it sells all inventory and collects all sales immediately. That means that at the end of the year, Slicenhook does not carry any inventory or accounts receivable balances. During 2018, Slicenhook has the following operating results:

Sales...........................................................................$1,126,000

Cost of goods sold....................................................400,000

Interest income from tax-exempt bonds..............900

Qualified dividend income from stock..................1,500

Operating expenses.................................................126,000

Depreciation (tax)

.....§179 on equipment......................$39,000

.....Equipment.....................................81,000

.....Building..........................................24,000............144,000

Interest expense on debt.........................................120,000

The partnership is very successful in its first year. The success allows Slicenhook to use excess cash from operations to purchase $15,000 of tax-exempt bonds (you can see the interest income already reflected in the operating results). The partnership also makes a principal payment on its loan from Big Bank in the amount of $300,000 and a distribution of $100,000 to each of the partners on December 31, 2018.

The partnership continues its success in 2019 with the following operating results:

Sales.............................................................................$1,200,000

Cost of goods sold......................................................420,000

Interest income from tax-exempt bonds.................900

Qualified dividend income from stock.....................1,500

Operating expenses....................................................132,000

Depreciation (tax)

......Equipment..............................$147,000

......Building...................................30,000.....................177,000

Interest expense on debt............................................96,000

The operating expenses include a $1,800 trucking fine that one of their drivers incurred for reckless driving and speeding and meals expense of $6,000.

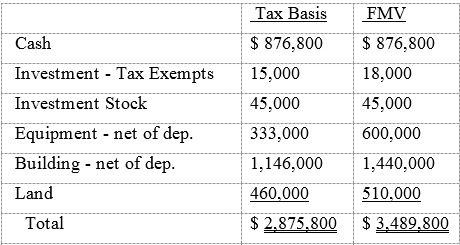

By the end of 2019, Reed has had a falling out with Carrie and Doug and has decided to leave the partnership. He has located a potential buyer for his partnership interest, Indie Ruff. Indie has agreed to purchase Reed€™s interest in Slicenhook for $730,000 in cash and the assumption of Reed€™s share of Slicenhook€™s debt. Carrie and Doug, however, are not certain that admitting Indie to the partnership is such a good idea. They want to consider having Slicenhook liquidate Reed€™s interest on January 1, 2020. As of January 1, 2020, Slicenhook has the following assets:

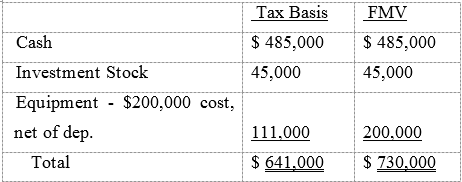

Carrie and Doug propose that Slicenhook distribute the following to Reed in complete liquidation of his partnership interest:

Slicenhook has not purchased or sold any equipment since its original purchase just after formation.

a. Determine each partner€™s recognized gain or loss upon formation of Slicenhook.

b. What is each partner€™s initial tax basis in Slicenhook on January 2, 2018?

c. Prepare Slicenhook€™s opening tax basis balance sheet as of January 2, 2018.

d. Using the operating results, what are Slicenhook€™s ordinary income and separately stated items for 2018 and 2019? What amount of Slicenhook€™s income for each period would each of the partner€™s receive?

e. Using the information provided, prepare Slicenhook€™s page 1 and Schedule K to be included with its Form 1065 for 2018. Also, prepare a Schedule K-1 for Carrie.

f. What are Carrie€™s, Reed€™s, and Doug€™s bases in their partnership interest at the end of 2018 and 2019?

g. If Reed sells his interest in Slicenhook to Indie Ruff, what is the amount and character of his recognized gain or loss? What is Indie€™s basis in the partnership interest?

h. What is Indie€™s inside basis in Slicenhook? What effect would a §754 election have on Indie€™s inside basis?

i. If Slicenhook distributes the assets proposed by Carrie and Doug in complete liquidation of Reed€™s partnership interest, what is the amount and character of Reed€™s recognized gain or loss? What is Reed€™s basis in the distributed assets?

j. Compare and contrast Reed€™s options for terminating his partnership interest. Assume that Reed€™s marginal tax rate is 35 percent and his capital gains rate is 15 percent.

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Essentials Of Federal Taxation 2019

ISBN: 9781260190045

10th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver