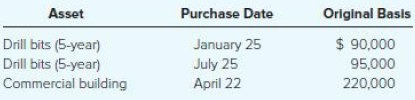

Dains Diamond Bit Drilling purchased the following assets this year. Assume its taxable income for the year

Question:

§179 expense (assume no bonus depreciation).

a. What is the maximum amount of §179 expense Dain may deduct for the year?

b. What is Dain€™s maximum depreciation deduction for the year (including §179 expense)?

c. If the January drill bits€™ original basis was $2,875,000, what is the maximum amount of §179 expense Dain may deduct for the year?

d. If the January drill bits€™ original basis was $3,875,000, what is the maximum amount of §179 expense Dain may deduct for the year?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essentials Of Federal Taxation 2019

ISBN: 9781260190045

10th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Question Posted: