Daisy Taylor has developed a viable new business idea. Her idea is to design and manufacture cookware

Question:

Daisy understands that it will take a few years for the business to become profitable. She would like to grow her business and perhaps at some point €œgo public€ or sell the business to a large retailer.

Daisy, who is single, decided to quit her full-time job so that she could focus all of her efforts on the new business. Daisy had some savings to support her for a while but she did not have any other source of income. She was able to recruit Kesha and Aryan to join her as initial equity investors in CTC. Kesha has an MBA and a law degree. Kesha was employed as a business consultant when she decided to leave that job and work with Daisy and Aryan. Kesha€™s husband earns close to $300,000 a year as an engineer (employee). Aryan owns a very profitable used car business. Because buying and selling used cars takes all his time, he is interested in becoming only a passive investor in CTC. He wanted to get in on the ground floor because he really likes the product and believes CTC will be wildly successful. While CTC originally has three investors, Daisy and Kesha have plans to grow the business and seek more owners and capital in the future.

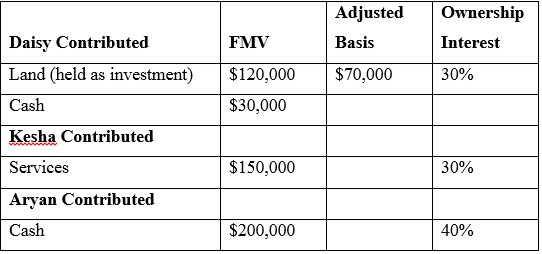

The three owners agreed that Daisy would contribute land and cash for a 30 percent interest in CTC, Kesha would contribute services (legal and business advisory) for the first two years for a 30 percent interest, and Daisy would contribute cash for a 40 percent interest. The plan called for Daisy and Kesha to be actively involved in managing the business while Aryan would not be. The three equity owners€™ contributions are summarized as follows:

Working together, Daisy and Kesha made the following five-year income and loss projections for CTC. They anticipate the business will be profitable and that it will continue to grow after the first five years.

Cool Touch Cookware 5-Year Income and Loss Projections

Year (Loss)....................Income

1.....................................($200,000)

2.....................................($80,000)

3.....................................($20,000)

4.....................................$60,000

5.....................................$180,000

With plans for Daisy and Kesha to spend a considerable amount of their time working for and managing CTC, the owners would like to develop a compensation plan that works for all parties. Down the road, they plan to have two business locations (in different cities). Daisy would take responsibility for the activities of one location and Kesha would take responsibility for the other. Finally, they would like to arrange for some performance-based financial incentives for each location.

To get the business activities started, Daisy and Kesha determined CTC would need to borrow $800,000 to purchase a building to house its manufacturing facilities and its administrative offices (at least for now). Also, in need of additional cash, Daisy and Kesha arranged to have CTC borrow $300,000 from a local bank and to borrow $200,000 cash from Aryan. CTC would pay Aryan a market rate of interest on the loan but there was no fixed date for principal repayment.

Required:

Identify significant tax and nontax issues or concerns that may differ across entity types and discuss how they are relevant to the choice of entity decision for CTC.

Step by Step Answer:

Essentials Of Federal Taxation 2019

ISBN: 9781260190045

10th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver