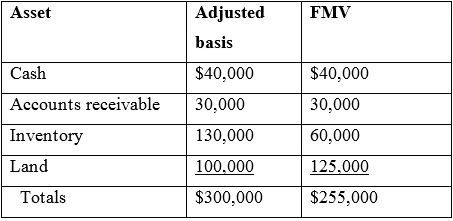

Rivendell Corporation uses the accrual method of accounting and has the following assets as of the end

Question:

a. What is Rivendell€™s net unrealized built-in gain at the time it converted to an S corporation?

b. Assuming the land was valued at $200,000, what would be Rivendell€™s net unrealized gain at the time it converted to an S corporation?

c. Assuming the land was valued at $125,000 but that the inventory was valued at $85,000, what would be Rivendell€™s net unrealized gain at the time it converted to an S corporation?

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essentials Of Federal Taxation 2019

ISBN: 9781260190045

10th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Question Posted: