Unilate Textiles is evaluating a new product, a silk/wool blended fabric. Assume you were recently hired as

Question:

a. Draw a cash flow time line that shows when the net cash inflows and outflows will occur, and explain how the time line can be used to help structure the analysis.

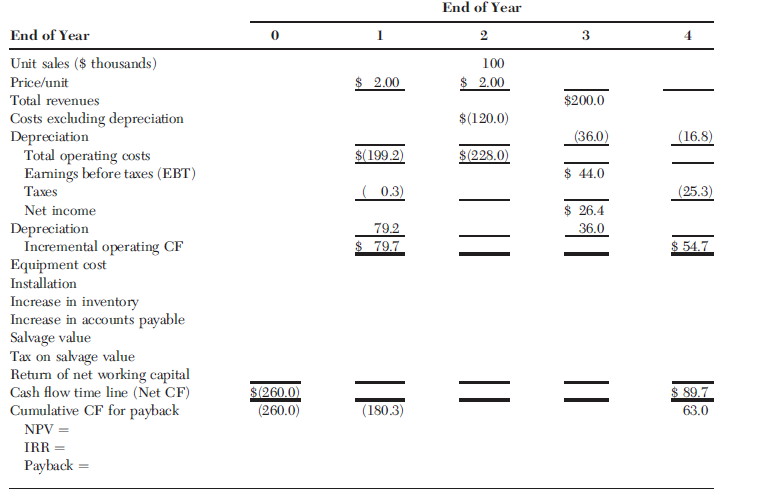

b. Unilate has a standard form that is used in the capital budgeting process; see Table IP10-1. Part of the table has been completed, but you must fill in the blanks. Complete the table in the following order:

(1) Complete the unit sales, sales price, total revenues, and operating costs excluding depreciation lines.

(2) Complete the depreciation line.

(3) Now complete the table down to net income and then down to net operating cash flows.

(4) Now fill in the blanks under Year 0 and Year 4 for the initial investment outlay and the terminal cash flows and complete the cash flow time line (net CF). Discuss working capital. What would have happened if the machinery were sold for less than its book value?

c. (1) Unilate uses debt in its capital structure, so some of the money used to finance the project will be debt. Given this fact, should the projected cash flows be revised to show projected interest charges? Explain.

(2) Suppose you learned that Unilate had spent $50,000 to renovate the building last year, expensing these costs. Should this cost be reflected in the analysis? Explain.

(3) Now suppose you learned that Unilate could lease its building to another party and earn $25,000 per year. Should this fact be reflected in the analysis? If so, how?

(4) Now assume that the silk/wool blend fabric project would take away profitable sales from Unilate€™s cotton/wool blend fabric business. Should this fact be reflected in your analysis? If so, how?

d. Disregard all the assumptions made in part c, and assume there was no alternative use for the building over the next four years. Now calculate the project€™s NPV, IRR, and traditional payback. Do these indicators suggest that the project should be accepted?

e. If this project had been a replacement project rather than an expansion project, how would the analysis have changed? No calculations are needed; just think about the changes that would have to occur in the cash flow table.

f. Assume that inflation is expected to average 3 percent over the next four years, that this expectation is reflected in the required rate of return, and that inflation will increase variable costs and revenues by the same relative amount of 3 percent. Does it appear that inflation has been dealt with properly in the analysis? If not, what should be done, and how would the required adjustment affect the decision?

Capital budgeting is a practice or method of analyzing investment decisions in capital expenditure, which is incurred at a point of time but benefits are yielded in future usually after one year or more, and incurred to obtain or improve the...

Step by Step Answer:

Essentials of Managerial Finance

ISBN: 978-0324422702

14th edition

Authors: Scott Besley, Eugene F. Brigham