Financial statement data for years ending December 31 for Amsterdam Company follow: a. Determine the inventory turnover

Question:

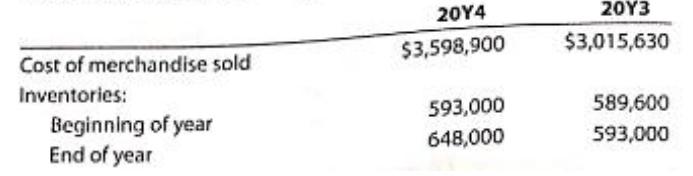

Financial statement data for years ending December 31 for Amsterdam Company follow:

a. Determine the inventory turnover for 20Y4 and 20Y3.

b. Determine the days’ sales in inventory for 20Y4 and 20Y3. Use 365 days and round to one decimal place.

c. Does the change in inventory turnover and the days’ sales in inventory from 20Y3 to 20Y4 indicate a favorable or an unfavorable trend?

20Υ4 20Υ3 Cost of merchandise sold $3,598,900 $3,015,630 Inventories: 593,000 589,600 Beginning of year End of year 648,000 593,000

Step by Step Answer:

ANSWER To solve this problem we need to calculate the inventory ...View the full answer

Accounting

ISBN: 9781337902687

28th Edition

Authors: Carl S. Warren, Christine Jonick, Jennifer Schneider

Related Video

Inventory turnover is a key metric that helps businesses evaluate the efficiency of their operations. A high turnover ratio is generally considered positive, indicating that the company is effectively selling its inventory and making efficient use of its resources. On the other hand, a low turnover ratio may indicate issues such as overstocking or slow sales and may require further examination to identify and address the underlying causes. Businesses use this ratio to make decisions about inventory levels, production schedules, and pricing strategies. It also helps businesses to identify areas where they may need to make improvements, such as reducing lead times for production or optimizing sales and marketing efforts. Additionally, inventory turnover is used by investors and analysts as a key performance indicator to evaluate the financial health and growth potential of a company.

Students also viewed these Business questions

-

Financial statement data for years ending December 31 for Latchkey Company follows: a. Determine the ratio of sales to assets for 2016 and 2015. b. Does the change in the ratio of sales to assets...

-

Financial statement data for years ending December 31 for Edison Company follows: a. Determine the ratio of sales to assets for 2016 and 2015. b. Does the change in the ratio of sales to assets from...

-

Financial statement data for years ending December 31 for Holland Company follows: a. Determine the inventory turnover for 2016 and 2015. b. Determine the number of days' sales in inventory for 2016...

-

Governments assert that their safety standards for food imports are important to ensure that their citizens not be harmed by unsafe foods. Comment on how such a concern may be a nontariff barrier.

-

Determine the angles subtended for the following conditions: (a) A 2-cm diameter pipe sighted by total station from 100 m (b) A 1/4-in. stake sighted by total station from 400 ft. (c) A 1/4-in....

-

Net farm income = $78,000 Average equity = $750,000 Average asset value = $1,350,000 Interest expense = $35,000 Total Cash Expense = $243,000 Gains from sales of capital assets = $16,000 Total...

-

Look at Exhibit 7,17, For each of the 10 tips on managing resistance and leading change, note some concrete actions you can take to help bring about change in a group at work or at school. (p. 249)

-

Assume the same set of facts for Stacy Company as in Problem 10-2 except that the market rate of interest of January 1, 2010, is 8% and the proceeds from the bond issuance equal $10,803. Required 1....

-

Acquisitions and other investing activity\ -0.4 \ Cash from investing activities\ -2.6_() \ Financing activities\ Dividends paid\ -1.5 \ Sale or purchase of stock\ Increase in short - term borrowing\...

-

European Styles, Inc. manufactures womens blouses of one quality, which are produced in lots to fill each special order. Its customers are department stores in various cities. European Styles sews...

-

On the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 9. Inventory Item Cost per Unit Market...

-

During the taking of its physical inventory on December 31, 20Y7, Combine Engine Company incorrectly counted its inventory as $274,100 instead of the correct amount of $270,700. Indicate the effect...

-

The reload provision in an employee stock option entitles its holder to receive X/S units of newly reloaded at-the-money options from the employer upon exercise of the stock option. Here, X is the...

-

Give an example of a program that will cause a branch penalty in the three-segment pipeline of Sec. 9-5. Example: Three-Segment Instruction Pipeline A typical set of instructions for a RISC processor...

-

Are Google, Microsoft, and Apple acting ethically? Are they being socially responsible? Eager to benefit from the economic growth and the job creation that foreign direct investments generate, many...

-

On May 1, 2011, Lenny's Sandwich Shop loaned \$20,000 to Joe Lopez for one year at 6 percent interest. Required Answer the following questions: a. What is Lenny's interest income for 2011? b. What is...

-

Tipton Corporations balance sheet indicates that the company has \($300,000\) invested in operating as sets. During 2006, Tipton earned operating income of \($45,000\) on \($600,000\) of sales....

-

Norton Car Wash Co. is considering the purchase of a new facility. It would allow Norton to increase its net income by \($90,000\) per year. Other information about this proposed project follows:...

-

Following is information for Marcel Ltes investments held for trading. Marcel is a public company and has a December 31 year end. 2021 Sept. 28 Purchased 3,500 shares of Cygman Limited for $40 per...

-

Several months have passed and the Managing Partner approved and properly filed the Complaint and properly submitted the Request for Production of Documents that you drafted. In fact, it has been 75...

-

Catherine Janeway Companys weekly payroll, paid on Fridays, totals $6,000. Employees work a 5-day week. Prepare Janeways adjusting entry on Wednesday, December 31, and the journal entry to record the...

-

Included in Martinez Companys December 31 trial balance is a note receivable of $10,000. The note is a 4-month, 12% note dated October 1. Prepare Martinezs December 31 adjusting entry to record $300...

-

Included in Martinez Companys December 31 trial balance is a note receivable of $10,000. The note is a 4-month, 12% note dated October 1. Prepare Martinezs December 31 adjusting entry to record $300...

-

A person purchased a $181,873 home 10 years ago by paying 20% down and signing a 30-year mortgage at 8.4% compounded monthly. Interest rates have dropped and the owner wants to refinance the unpaid...

-

3 . Accounting.. How does depreciation impact financial statements, and what are the different methods of depreciation?

-

NEED THIS EXCEL TABLE ASAP PLEASE!!!! Presupuesto Operacional y C lculo del COGS Ventas Proyectadas: Ventas Proyectadas: $ 4 5 0 , 0 0 0 Precio por unidad: $ 4 5 0 Unidades vendidas: 4 5 0 , 0 0 0 4...

Study smarter with the SolutionInn App