Jefferson Animal Rescue is a private not-for-profit clinic and shelter for abandoned domesticated animals, chiefly dogs and

Question:

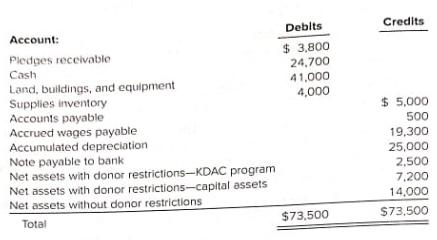

Jefferson Animal Rescue is a private not-for-profit clinic and shelter for abandoned domesticated animals, chiefly dogs and cats. At the end of 2019, the organization had the following account balances:

The following took place during 2020:

1. Additional supplies were purchased on account in the amount of $16,050.

2. Unconditional (and unrestricted) pledges of support were received totaling $95,000. In light of a declining economy, 4 percent is expected to be uncollectible. The remainder is expected to be collected in 2020.

3. Supplies used for animal care amounted to $17,200.

4. Payments made on accounts payable amounted to $17,100.

5. Cash collected from pledges totaled $90,500.

6. Salaries were paid in the amount of $47,500. Included in this amount is the accrued wages payable at the end of 2019. (The portion of wages expense attributable to administrative expense is $15,000, and fundraising expense is $2,000. The remainder is for animal care.)

7. Jefferson Animal Rescue entered an agreement with KDAC, Channel 7 News, to find more homes for shelter pets. This special adoption program highlights a shelter animal in need of a home on the evening news the first Thursday of each month. The program was initially funded by a restricted gift. During 2020, Jefferson Animal Rescue paid $1,800 ($150 per month) for the production of the monthly videos. In December 2020, the original donor unconditionally pledged to support the project for an additional 24 months by promising to pay $3,600 in January 2021 (all of this is expected to be collectible).

8. The shelter’s building was partially financed by a bank note with an annual interest rate of 6 percent. Interest totaling $1,250 was paid during 2020. Interest is displayed as Other Changes in the Statement of Activities.

9. Animal medical equipment was purchased during the year in the amount of $5,200. Funding came from a special capital campaign conducted in 2019.

10. Depreciation for the year amounted to $6,000. (The portion of depreciation expense attributable to administrative is $2,000, and the remainder is related to animal care.)

11. Unpaid wages relating to the final week of the year totaled $775 (all animal care). Using the information above and the Excel template provided:

a. Prepare journal entries and post entries to the T-accounts.

b. Prepare closing entries.

c. Prepare a Statement of Activities, Statement of Financial Position, and Statement of Cash Flows for the year ending December 31, 2020.

Step by Step Answer:

Essentials Of Accounting For Governmental And Not-for-Profit Organizations

ISBN: 9781260570175

14th Edition

Authors: Paul Copley