One can obtain a good conceptual understanding of CAPM beta by reading texts, but they cannot fully

Question:

One can obtain a good conceptual understanding of CAPM beta by reading texts, but they cannot fully appreci- ate what it represents until they calculate a beta themselves and without relying on someone to give them the beta value. In this case, you will use real-world pricing data to calculate beta.

Required

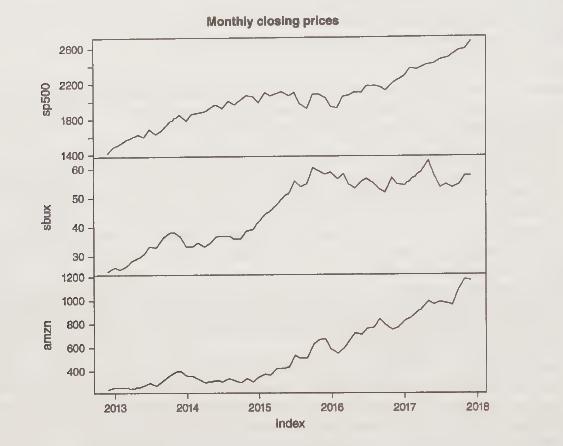

a. Using only the following price data, calculate the CAPM betas of Starbucks (SBUX) and Amazon (AMZN) stocks. The data are available for download and readable by MS Excel at https://goo.gl/ TzdnU1. A tutorial for using Microsoft Excel to make CAPM beta calculations written by one of the authors for his students is available at https://goo.gl/9ASRVp.

b. The following is a plot of the monthly prices in the data set. Does the plot have any relation to the CAPM betas you calculated? Explain.

c. After completing part one of this case, use the CAPM to calculate the cost of equity capital of SBUX and AMZN. Assume a risk-free rate of 2 percent and expected rate of return on the market portfolio of 8 percent. Then, if SBUX and AMZN each wanted to raise \($100\) million in equity capital, what do your calculations of their cost of equity say about their new stock issues relative to each other?

Step by Step Answer: