The Mosquito Abatement Commission is a newly organized federal agency with three primary programs: coordinating state government

Question:

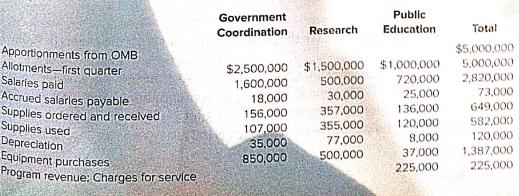

The Mosquito Abatement Commission is a newly organized federal agency with three primary programs: coordinating state government abatement functions, conducting research on mosquito abatement, and promoting abatement through public education. The following information is available at the end of the first quarter (December 31, 2020):

Required:

Prepare a Statement of Net Cost for the quarter ended December 31.

Transcribed Image Text:

Government Public Coordination Research Education Total $5.000.000 5.000,000 2,820,000 73,000 Apportionments from OMB Allotments-first quarter Salaries paid Accrued salaries payable Supplies ordered and received Supplies used Depreciation Equipment purchases Program revenue: Charges for service $2,500,000 $1,500,000 $1,000,000 720.000 25,000 136,000 120,000 1,600,000 18,000 500,000 30,000 649,000 156,000 107,000 35,000 850,000 357,000 355,000 77,000 500,000 582.000 120,000 8,000 37,000 225,000 1,387,000 225,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (9 reviews)

ANSWER Statement of Net Cost For the Quarter Ended December 31 2020 Programs Amount Government Coord...View the full answer

Answered By

Aketch Cindy Sunday

I am a certified tutor with over two years of experience tutoring . I have a passion for helping students learn and grow, and I firmly believe that every student has the potential to be successful. I have a wide range of experience working with students of all ages and abilities, and I am confident that I can help students succeed in school.

I have experience working with students who have a wide range of abilities. I have also worked with gifted and talented students, and I am familiar with a variety of enrichment and acceleration strategies.

I am a patient and supportive tutor who is dedicated to helping my students reach their full potential. Thank you for your time and consideration.

0.00

0 Reviews

10+ Question Solved

Related Book For

Essentials Of Accounting For Governmental And Not-for-Profit Organizations

ISBN: 9781260570175

14th Edition

Authors: Paul Copley

Question Posted:

Students also viewed these Business questions

-

The following information is available at the end of the period for the completed job 73: beginning balance $17,000 direct materials $30,600 direct labor $24,500 overhead applied $41,700 total number...

-

At the end of the first quarter of Year 2, McKinney & Co. reevaluates its receivables. McKinney & Co.s management decides that $8,500 due from Mangold Corporation will not be collectible. This amount...

-

At the end of the first quarter of 201X, you are asked to determine the FUTA tax liability for Carter Company. The FUTA tax rate is 0.8% on the first $7,000 each employee earns during the year...

-

You are looking at buying a piece of real estate and you intend to borrow as much as you possibly can from a bank to buy the property. The bank you are dealing with has a requirement that the LVR for...

-

Under what conditions would Apple use an offensive strategic market plan?

-

On February 1, 2018, Arrow Construction Company entered into a three-year construction contract to build a bridge for a price of $8,360,000. During 2018, costs of $2,120,000 were incurred with...

-

Explain the use of nonbudgetary control techniques. LO.1

-

Truax Co. issued $250,000 of 6 percent, 10-year, callable bonds on January 1, 2013, at their face value. The call premium was 2 percent (bonds are callable at 102). Interest was payable annually on...

-

Fletcher Company collected the following data regarding production of one of its products. Compute the standard quantity allowed for the actual output. Direct materials standard (6 lbs. @ $2/lb.) $...

-

1. How many minutes, on average, does it takes for a first-edition patron to get the requested book from time of entry into the library? (State all assumptions and show the calculations.) 2. How many...

-

Assume the Federal Interstate Commission began the fiscal year with the following account balances: 1. Congress passed a spending bill providing $16,000,000 to fund the agencys operations for the...

-

The 2018 financial statements of the Internal Revenue Service are available at: http://www.gao.gov/products/GAO-19-150 Use these to answer the following questions: a. Statement of Net Cost 1. What...

-

As in Section 6.3, Exercise 5, the sample space is S = {0, 1, 2, 3, 4}, Pr({0}) = 0.2, Pr({1}) = 0.3, Pr({2}) = 0.4, Pr({3}) = 0.1, Pr({4}) = 0.0, A = {0, 1, 2}, and B = {0, 2, 4}. In the above...

-

The relationship between income and savings, let's look back to the recent credit crisis that sent our economy into the greatest financial crisis since the Great Depression. Watch this short video...

-

Jos Lpez has $15,000 in a 6-year certificate of deposit (CD) that pays a guaranteed annual rate of 4%. Create a timeline showing when the cash flows will occur. (6 points) 2. Oliver Lpez deposits...

-

PROBLEM SET #2 At a large urban college, about half of the students live off campus in various arrangements, and the other half live on campus. Is academic performance dependent on living...

-

Post a compelling argument stating whether leaders are born, made, or a combination of both. Drawing from the discussion of the two current peer-reviewed articles you identified, support your...

-

Unicorn Inc. builds commercial jets and calculate the cost for each jet. For each item below, indicate whether it would be most likely classified as direct labor (DL); direct materials (DM);...

-

Using T accounts, post the following journal entries to the general ledger and calculate ending balances. General Journal Date Account titles Debit Credit Accounts Receivable Service Revenue Sept. 2...

-

For the following arrangements, discuss whether they are 'in substance' lease transactions, and thus fall under the ambit of IAS 17.

-

You have been assigned the task of writing the audit report for the City of X. The scope includes the basic financial statements, although the report is attached to a complete Comprehensive Annual...

-

With respect to the Single Audit Act of 1984 and amendment of 1996 relating to state and local governments and not-for-profit organizations: a. Distinguish between major and non-major programs. b....

-

A local government has five federal grants. Expenditures amounted to $2,000,000 during the year, as follows: Type A HUD grant, new and never audited.........$600,000 HHS grant, audited last year, no...

-

XF Ltd. Is an expanding private company in the electric trade. Accounts preparing in January 2019 included the following information: Profit Statement for the year ended 31 st December 2018 Kshs.000...

-

Check On June 15, 2021, Sanderson Construction entered into a long-term construction contract to build a baseball stadium in Washington D.C., for $340 million. The expected completion date is April...

-

Q.1 Bassem Company purchased OMR420,000 in merchandise on account during the month of April, and merchandise costing OMR $350,000 was sold on account for OMR 425,000. Required: 1. Prepare journal...

Study smarter with the SolutionInn App