A stock portfolio consisting of the 10 companies identified by Fortune magazine each year as Americas most

Question:

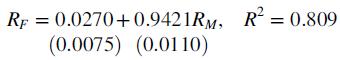

A stock portfolio consisting of the 10 companies identified by Fortune magazine each year as America’s most admired companies was compared to the overall U.S. stock market [24]. A least squares regression was used to analyze the relationship between the risk-adjusted daily percentage return on the Fortune portfolio RF with the riskadjusted daily return on the market as a whole RM:

There were 5,547 observations. The standard errors are in parentheses.

a. The average value of RM is 0.0522 percent (this is not 5 percent, but about 1/20 of 1 percent). What is the average value of RF?

b. Is the difference between the average value of RF and RM substantial? Explain your reasoning.

b. Test the null hypothesis that the slope is equal to 1.

c. Test the null hypothesis that the intercept is equal to 0.

Step by Step Answer:

Essential Statistics Regression And Econometrics

ISBN: 9780123822215

1st Edition

Authors: Gary Smith