22. Colinos Associates is an investment management firm utilizing a very rigorous and disciplined asset al1ocation methodology

Question:

22. Colinos Associates is an investment management firm utilizing a very rigorous and disciplined asset al1ocation methodology as a key element of its investmen t approach. Twice a year, three or four economic scenarios are developed, based on thejudgment of Colinos' most senior people. Probabilities are then assigned to the scenarios; return forecasts for U.S. stocks, bonds, and cash equivalents (the only asset types used by the firm) are generated; and expected values are computed for each asset category. These expected values are then combined with historical standard deviations and covariances to produce forecasts of results from various corn binations of the th ree asset classes.

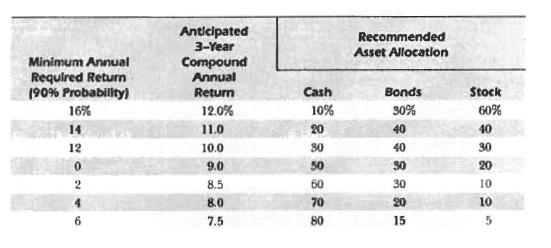

From this range of possible outcomes, senior staff selects what it regards as the best asset combinations, defined as those combinations promising the highest three-year returns with a 90% probability of achieving a pre-set minimum annual return requirement. These optimal al1ocations (sample output in the fol1owing table) are then presented to al1 clients for discussion and implementation.

The process is repeated in roughly six months' time, when new allocations are developed.

a. Discuss the strengths and weaknesses of Colinos' asset al1ocation approach.

b. Recommend and justify an alternative asset al1ocation approach for wealthy individuals.

Step by Step Answer:

Investments

ISBN: 9788120321014

6th Edition

Authors: William F. Sharpe, Gordon J. Alexander, Jeffery V. Bailey