8. Buzz Arlett, a portfolio manager for an investment management firm, has estimated the following risk-return characteristics

Question:

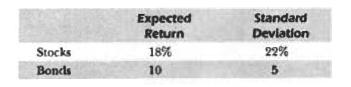

8. Buzz Arlett, a portfolio manager for an investment management firm, has estimated the following risk-return characteristics for the stock and bond markets.

The correlation between stocks and bonds is estimated to be .50.

Using these estimates, Buzz ran a number of simulations, tracing out the implications of different bond-stock mixes for the financial situation of Zinn Beck, a client. After much thought, Zinn indicated that, of the mixes considered, the most desirable was the al1ocation of 60% to stocks and 40% to bonds.

Given this information, calculate Zinn's risk tolerance. [Hint: To solve this problem algebraical1y, write Equation (23.5) using the 60:40 stock-bond allocation, Do the same for a 61:39 al1ocation. Final1y, set these two formulas equal to each other and solve for the risk tolerance.] Is this answer likely to represent Zinri's risk tolerance over all possible stock-bond allocations?

Step by Step Answer:

Investments

ISBN: 9788120321014

6th Edition

Authors: William F. Sharpe, Gordon J. Alexander, Jeffery V. Bailey