How many pounds would the investor in Example 19.2 need to sell forward to hedge exchange rate

Question:

How many pounds would the investor in Example 19.2 need to sell forward to hedge exchange rate risk if:

(a) r(UK) = 20%; and

(b) r(UK) = 30%?

Transcribed Image Text:

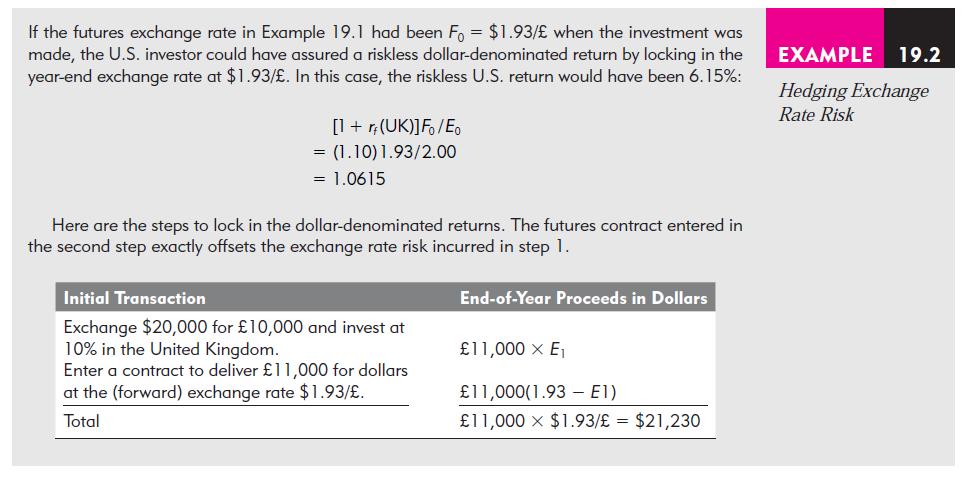

If the futures exchange rate in Example 19.1 had been Fo= $1.93/£ when the investment was made, the U.S. investor could have assured a riskless dollar-denominated return by locking in the year-end exchange rate at $1.93/£. In this case, the riskless U.S. return would have been 6.15%: [1 + rf (UK)]Fo/Eo = (1.10) 1.93/2.00 = 1.0615 Here are the steps to lock in the dollar-denominated returns. The futures contract entered in the second step exactly offsets the exchange rate risk incurred in step 1. Initial Transaction Exchange $20,000 for £10,000 and invest at 10% in the United Kingdom. Enter a contract to deliver £11,000 for dollars at the (forward) exchange rate $1.93/£. Total End-of-Year Proceeds in Dollars £11,000 X E₁ £11,000(1.93 E1) £11,000 x $1.93/£ = $21,230 EXAMPLE 19.2 Hedging Exchange Rate Risk

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (6 reviews)

You must sell forward the number of pounds you will ...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Essentials Of Investments

ISBN: 9780073368719

7th Edition

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

Question Posted:

Students also viewed these Business questions

-

Your company president is concerned about the effect of interest-rate changes on rate sensitive assets and liabilities. You have presented an analysis of both the income and the duration gap of the...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

The current quoted price of a 13% coupon bond is $110. It pays coupon semi-annually. The next coupon will be paid in 6-days (total number of days in this semi-annual period is 181) and the futures...

-

Using the formula in this chapter, a researcher determines that at the 95 percent confidence level, a sample of 2,500 is required to satisfy a clients requirements. The researcher actually uses a...

-

Your parents will retire in 18 years. They currently have $250,000, and they think they will need $1 million at retirement. What annual interest rate must they earn to reach their goal, assuming they...

-

MicroStorage Technology (MST) is developing a high-speed modem to connect handheld computers Problem 13.44 with a satellite-based data network. Cost Reduction {LO 4) Required a. Given the following...

-

Paik Company maintains a petty cash fund for small expenditures. These transactions occurred during the month of August. Aug. 1 Established the petty cash fund by writing a check on Westown Bank for...

-

on april 1 ringo company borrowed $20,000 from its bank by issuing a 9% , 12 month note, with the interest to be paid on the maturity date assuming ringo company makes reversing entries, prepare the...

-

Using the data in Example 19.1, calculate the rate of return in dollars to a U.S. investor holding the British bill if the year-end exchange rate is: (a) E 1 = $2.00/; (b) E 1 = $2.20/. EXAMPLE 19.1...

-

Suppose you like the plan of tilting savings toward later years, but worry about the increased risk of postponing the bulk of your savings to later years. Is there anything you can do to mitigate the...

-

Compute the reactions and draw the shear and moment curves for the beam in Figure P9.19. Given: EI is constant. Use the reactions at \(B\) as the redundants. A W L B

-

The Taylor series for natural logarithm (with base e) In(1+r) is In(1+2) -(-1)+1 for <1. (a) Write a user-defined function using loop that determines In(1+x) using the above Taylor series. Your...

-

Question 1: [up to 4 pts] Suppose that a = 1, a2 = 2, a3 = = 3, and an = an-3 for all n 4. If an integral with respect to y is used to find the area of R, what should the upper limit of integration...

-

Sunn Company manufactures a single product that sells for $180 per unit and whose variable costs are $141 per unit. The company's annual fixed costs are $636,000. The sales manager predicts that next...

-

Question 22(5 points) Silver Corp. declares a 15% stock dividend to its shareholders on 1/18. On that date, the company had 15,000 shares issued and 12,000 shares outstanding. Silver Corp. common...

-

Select your a diagnosis from the DSM-5. using your information found through a search of the literature available on your selected diagnosis using appropriate references of peer reviewed journal...

-

In Steckel rolling, the rolls are idling, and thus there is no net torque, assuming frictionless bearings. Where, then, is the energy coming from to supply the necessary work of deformation in...

-

How do individual companies respond to economic forces throughout the globe? One way to explore this is to see how well rates of return for stock of individual companies can be explained by stock...

-

Ann deposits $100 at the end of each month into her bank savings account. The bank paid 6% nominal interest, compounded and paid quarterly. No interest was paid on money not in the account for the...

-

What is the present worth of a series of equal quarterly payments of $3000 that extends over a period of 8 years if the interest rate is 10% compounded monthly?

-

The first of a series of equal semiannual cash flows occurs on July 1, 1997, and the last occurs on January 1, 2010. Each cash flow is equal to $128,000. The nominal interest rate is 12% compounded...

-

For the following seven situations, please identify one assumption, principle, or constraint that is being followed 1. The financial statements should be combined for your company and the company in...

-

Task: 2 The Muscat City for the year 2019 maintain two funds: a General Fund accounts for its unrestricted resources and general operations, and a Proprietary funds for internal services and State...

-

Hyrkas Corporation's most recent balance sheet and income statement appear below: Statement of Financial Position December 31, Year 2 and Year 1 (in thousands of dollars) Year 2 Year 1 Asset: Current...

Study smarter with the SolutionInn App