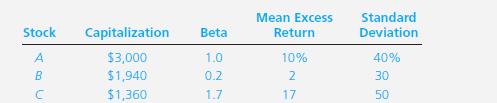

The data below describe a three-stock financial market that satisfies the single-index model. The standard deviation of

Question:

The data below describe a three-stock financial market that satisfies the single-index model.

The standard deviation of the market index portfolio is 25%.

a. What is the mean excess return of the index portfolio?

b. What is the covariance between stock A and stock B?

c. What is the covariance between stock B and the index?

d. Break down the variance of stock B into its systematic and firm-specific components.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: