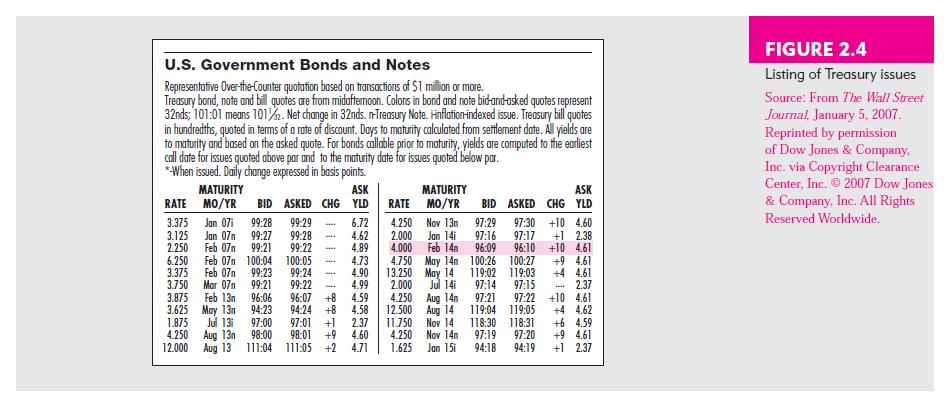

Turn back to Figure 2.4 and look at the fi rst Treasury bond maturing in November 2014.

Question:

Turn back to Figure 2.4 and look at the fi rst Treasury bond maturing in November 2014.

a. How much would you have to pay to purchase one of these bonds?

b. What is its coupon rate?

c. What is the current yield of the bond?

Transcribed Image Text:

U.S. Government Bonds and Notes Representative Over-the-Counter quotation based on transactions of $1 million or more. Treasury bond, note and bill quotes are from midafternoon. Colons in bond and note bid-and-asked quotes represent 32nds; 101:01 means 101%. Net change in 32nds. n-Treasury Note. Hinflation-indexed issue. Treasury bill quotes in hundredths, quoted in terms of a rate of discount. Days to maturity calculated from settlement date. All yields are to maturity and based on the asked quote. For bonds callable prior to maturity, yields are computed to the earliest call date for issues quoted above par and to the maturity date for issues quoted below par. *-When issued. Daily change expressed in basis points. ASK BID ASKED CHG YLD MATURITY RATE MO/YR 3.375 3.125 2.250 Jan 07i Jan 07n Feb 07 6.250 Feb 07m 3.375 Feb 07m 3.750 Mar 07 3.875 Feb 13 3.625 May 13 1.875 Jul 13i 4.250 Aug 13 12.000 Aug 13 99:28 99:29 99:28 99:22 99:27 99:21 100:04 99:23 99:21 100:05 99:24 99:22 M 96:06 96:07 +8 94:24 +8 94:23 97:00 97:01 +1 98:00 98:01 +9 111:04 111:05 +2 88799 6.72 4.62 4.89 4.73 4.90 4.99 4.59 4.58 2.37 4.60 4.71 RATE 4.250 2.000 4.000 MATURITY MO/YR Nov 13m Jan 14i Feb 14 4.750 May 14m 13.250 May 14 2.000 Jul 14i 4.250 12.500 11.750 4.250 1.625 Aug 14 Aug 14 Nov 14 Nov 14 Jan 15i ASK YLD BID ASKED CHG 97:29 97:30 +10 4.60 97:16 97:17 +1 2.38 96:09 96:10 +10 4.61 100:26 100:27 +9 4.61 119:02 119:03 +4 4.61 97:14 97:15 2.37 97:21 97:22 +10 4.61 119:04 119:05 +4 4.62 +6 4.59 +9 4.61 +1 2.37 118:30 118:31 97:19 97:20 94:18 94:19 *** FIGURE 2.4 Listing of Treasury issues Source: From The Wall Street Journal, January 5, 2007. Reprinted by permission of Dow Jones & Company, Inc. via Copyright Clearance Center, Inc. © 2007 Dow Jones & Company, Inc. All Rights Reserved Worldwide.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

Based on Figure 24 a To purchase the Treasury bond maturing in November 2014 you would have to pay t...View the full answer

Answered By

Qurat Ul Ain

Successful writing is about matching great style with top content. As an experienced freelance writer specialising in article writing and ghostwriting, I can provide you with that perfect combination, adapted to suit your needs.

I have written articles on subjects including history, management, and finance. Much of my work is ghost-writing, so I am used to adapting to someone else's preferred style and tone. I have post-graduate qualifications in history, teaching, and social science, as well as a management diploma, and so am well equipped to research and write in these areas.

4.80+

265+ Reviews

421+ Question Solved

Related Book For

Essentials Of Investments

ISBN: 9780073368719

7th Edition

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

Question Posted:

Students also viewed these Business questions

-

Turn back to figure and look at the Treasury bond maturing in February 2039. a. How much would you have to pay to purchase one of these notes? b. What is its coupon rate? c. What is the current yield...

-

A Treasury bond maturing in November 2014 and callable in November 2009 has a quoted price of 107:06 and a coupon rate of 11.75 percent. Assuming the bond matures in exactly 6 years, what is the...

-

1. You want to quit your job and go back to school for a law degree 4 years from now, and you plan to save $3,400 per year, beginning immediately . You will make 4 deposits in an account that pays...

-

Does the customer buying process end when a customer buys some merchandise? Explain your answer.

-

List and describe four factors that influence how difficult the problem-definition process can be.

-

The beam has a weight w per unit length. Determine the internal normal force, shear force, and moment at point C due to itsweight. www

-

In what situations might a manager wish to overstate liabilities?

-

Futabatei Enterprises purchased a delivery truck on January 1, 2014, at a cost of $27,000. The truck has a useful life of 7 years with an estimated salvage value of $6,000. The straight-line method...

-

AutoSave OF AAP 2G ... Chapter 11 Exercises Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Arial v 10 ab Wrap Text General Insert v X LA ~ A VA AY v Delete Paste B 1 Uv...

-

Suppose XYZs final price in Table 2.4 increases in price to $110, while ABC falls to $20. Find the percentage change in the price-weighted average of these two stocks. Compare that to the percentage...

-

Straight preferred stock yields often are lower than yields on straight bonds of the same quality because of a. Marketability b. Risk c. Taxation d. Call protection

-

Over several years, students of Professor Robin Lock have flipped a large number of coins and recorded whether the flip landed heads or tails. As reported in a 2002 issue of Chance News, these...

-

1.Sony has just released a new CD recording (okay, not new because we don't buy CDS) but anyway.Here is some cost and price information: CD Disc and Packaging (material and labor) $1.75/CD...

-

Admin Support Cereal Bars Square Foot 1,250 1,500 7,500 7,000 # of employees 14 11 42 59 # of machine batches 0 0 14 27 # of computers 17 21 35 30 Costs 32,000.32 21,740.21 The Support department...

-

Compare and contrast the differences between innovation and creativity. Does one lead to the other? If so, please explain. Why is innovation important? Who within the organization is responsible for...

-

Using the tables from Check your Consumer Surplus and Producer Surplus activities, find the equilibrium price and quantity in the market for cheese-stuffed jalapeno peppers. What is the total surplus...

-

We decided to use Gehan's two-stage design for this purpose. In the first stage, we will discard the new treatment if no patient out of n0 patients. Suppose the probability we can tolerate to discard...

-

The modulus of elasticity of gray iron varies significantly with its type, such as the ASTM class, Explain why.

-

For liquid water the isothermal compressibility is given by; where r and b are functions of temperature only. If 1 kg of water is compressed isothermally and reversibly from I to 500 bar at 60(C. how...

-

A 10-year bond of a firm in severe financial distress has a coupon rate of 14% and sells for $900. The firm is currently renegotiating the debt, and it appears that the lenders will allow the firm to...

-

A 2-year bond with par value $1,000 making annual coupon payments of $100 is priced at $1,000. What is the yield to maturity of the bond? What will be the realized compound yield to maturity if the...

-

An investor believes that a bond may temporarily increase in credit risk. Which of the following would be the liquid method of exploiting this? a. The purchase of a credit default swap. b. The sale...

-

Steelers Football, Inc. (SFI) needs to prepare a bank reconciliation for September. The information from SFIs bank statement and cash account is summarized below. Bank Statement Cash Account Records...

-

Product A Product B Monthly sales in dollars $ 120,000 $ 100,000 Contribution margin ratio 20% 64% If the fixed cost is $50,000. Required: A. Compute the overall break-even point for the company in...

-

4. Show the operating break even point if a company has fixed costs of $200, a sales price of $15, and variables costs of $10. (2 points) F = $200 Quantity Revenues Fixed Costs Total Costs P = $15 0...

Study smarter with the SolutionInn App