Pam Rummey had been involved in the equestrian activity of dressage for almost two decades. She has owned several horses and participated in dressage competitions.

Pam Rummey had been involved in the equestrian activity of dressage for almost two decades. She has owned several horses and participated in dressage competitions. Her expertise was in the development and training of horses for dressage competitions. She would often purchase young horses and train them and then sell them to other dressage horse owners for competitions. However, in about 2009 she started to sell her horses, and by 2015, she had only one horse remaining, Silver. Between 2015 and 2017, Pam was able to breed Silver five times, earning $2,000 each time. In 2017, Silver died.

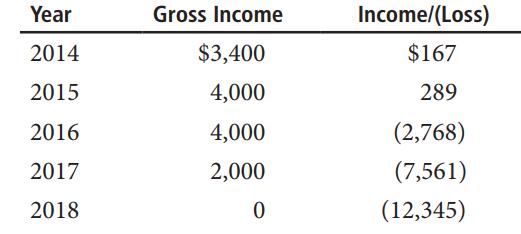

Her results from the previous five years of her horse-related activities were as follows:

In the years prior to 2014, Pam generated profits (no losses) ranging from just over $23,000 to just under $2,100 in any given year. In 2019, Pam embarked on a business mission to identify a new horse she could develop and then sell at a profit. She let it be known (by word-of-mouth) that she was interested in a new horse. She spent time on the Internet looking for horses and also attended (but did not compete in) a number of dressage competitions in 2019, where she let it be known she was thinking about purchasing new horse but made no offers to purchase. She also “lunged” about a dozen horses, which is a form of pre-training where the horse runs around the trainer in a circle while attached to a long rope. Although lunging usually lasts only 45 minutes, Pam also prepared the horses for their exercise, cooled them down afterward, and washed them. All this could take up to 3 hours total. Pam claims to have used a basic bookkeeping software to keep track of her books and records but her computer was damaged in 2017 and all records were lost. Pam no longer kept detailed records after that time. She reported no income in 2019 but did deduct a $6,345 loss on her tax return related to her horse business.

Pam is able to maintain her household expenses through her job as a data entry programmer for which she has been paid anywhere between $40,000 and $70,000 per year over the last decade. Under § 162, taxpayers are eligible to deduct the ordinary and necessary business expenses of carrying on a trade or business. In 2019, is Pam’s horse-related activity a trade or business?

Year Gross Income Income/(Loss) 2014 $3,400 $167 2015 4,000 289 2016 4,000 (2,768) 2017 2,000 (7,561) 2018 (12,345)

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

The code includes a statutory safe harbor for the training of horses indicating that businesses that make a profit in two years of every seven years are considered to be for a profit IRC 183d In Pams ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards