A married taxpayer, age 57, has the following receipts: During the tax year, the taxpayer pays $2,200

Question:

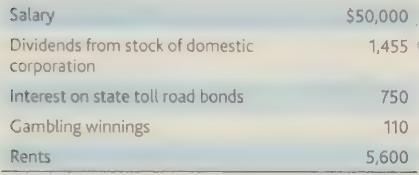

A married taxpayer, age 57, has the following receipts:

During the tax year, the taxpayer pays $2,200 in taxes on his rental property and $2,650 for its operation and maintenance. He had gambling losses of $65. He made no charitable contributions. Calculate the taxpayer's gross income, adjusted gross income, and taxable income.

Transcribed Image Text:

Salary Dividends from stock of domestic corporation Interest on state toll road bonds Gambling winnings Rents $50,000 1,455 750 110 5,600

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

ANSWER Lets calculate the taxpayers gross income ...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

A marriedtaxpayer, age 57, has the following receipts: Salary $50,000 Dividends from stock of domestic corportaion $1,455 Interest on state toll road bonds $750 Gambling winning $110 Rents $5,600...

-

Jack Dawn Milo (her Daddy wanted a boy) age 37 lived at 416 Grouse Avenue, Allentown, PA 18105. Jacks mother, Lulu Belle Taxdeduction age 65, is a resident of Windsor, Canada. Jack provides all of...

-

Find a minimum spanning tree for the following graph using all 3 algorithms 13 17 22- 20 15, a. Adding the shortest edge first b. Deleting the longest edge first c. Growing a tree from the node D

-

What are hydrogen bonds and how are they important in the body?

-

ASF and Company is planning to introduce a new line of products that would involve increasing its current assets by 40 million its existing and new assets structures are Details Existing New Current...

-

PROBLEM 216 Plantwide Predetermined Overhead Rates; Pricing LO21, LO22, LO23 Landen Corporation uses a job-order costing system. At the beginning of the year, the company made the following...

-

This exercise develops a space-efficient variant of the forward'backward algorithm described in Figure. We wish to compute P (X k?e l; t) for k = 1... t. This will be done with a divide-and-conquer...

-

Mr. Bond is considering purchasing a bond with 8-year maturity and $1,000 face value. The coupon interest rate is 8% and the interest is paid annually. If Mr. Bond requires 10% yield to maturity on...

-

Robert Reed, a bachelor, maintains his parents in a nursing home. They have no income of their own and are completely dependent on their son. His parents are 75 and 72 years of age. Robert has the...

-

An individual performed special valuable services not called for by his employment, in consideration for which his employer agreed to pay him a bonus in an amount to be determined later. After due...

-

How would DSW establish its credibility with suppliers with respect to the ability to identify and implement change?

-

Research a company that declared a 100% stock dividend or a two-for-one split Contrast the differences between a stock dividend and a stock split. Imagine that you are a stockholder in a company....

-

What are your ideas for Implementation and Assessing the Solution? How did you implement and assess the success? What should the time frame look like? What resources will be needed? What criteria...

-

What is an aesthetic question a viewer might ask about a work of art? 1 . What principles of design were used to make this work? 2 . What qualifies a functional object like this as a work of art? 3 ....

-

2. A phase diagram is shown below for an allotropic metal. Sketch and label possible Gibbs free energy curves for the 3 phases, as a function of temperature for the pressure indicated. Does the a or...

-

Recommend at least one (1) way a business with which you are familiar could use social media / buzz marketing to increase sales and awareness (e.g., social media awareness) of your...

-

What type of syndicate data will be useful to Dunkin' Donuts?

-

A sample statistic will not change from sample to sample. Determine whether the statement is true or false. If it is false, rewrite it as a true statement.

-

Evaluate this statement: An S corporation can facilitate the meeting of its state income tax filing obligations by developing a common spreadsheet that allocates and apportions income among the...

-

Create a PowerPoint outline describing the major exemptions and exclusions from the sales/use tax base of most states. Use your slides to discuss this topic with your accounting students' club.

-

Your client, HillTop, is a retailer of women's clothing. It has increased sales during the holiday season by advertising gift cards for in-store and online use. HillTop has found that gift card...

-

When credit terms for a sale are 2/15, n/40, the customer saves by paying early. What percent (rounded) would this savings amount to on an annual basis

-

An industrial robot that is depreciated by the MACRS method has B = $60,000 and a 5-year depreciable life. If the depreciation charge in year 3 is $8,640, the salvage value that was used in the...

-

What determines a firm's beta? Should firm management make changes to its beta? Be sure to consider the implications for the firm's investors using CAPM.

Study smarter with the SolutionInn App