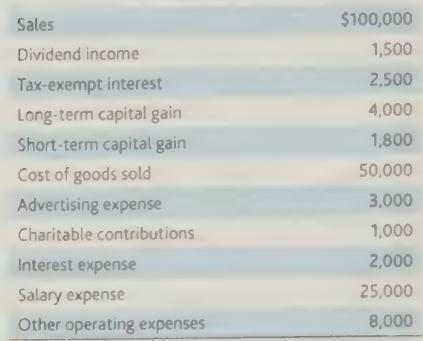

An S corporation has the following information: Compute the S$ corporation's taxable income for the year. Sales

Question:

An S corporation has the following information:

Compute the S$ corporation's taxable income for the year.

Transcribed Image Text:

Sales Dividend income Tax-exempt interest Long-term capital gain Short-term capital gain Cost of goods sold Advertising expense Charitable contributions Interest expense Salary expense Other operating expenses $100,000 1,500 2,500 4,000 1,800 50,000 3,000 1,000 2,000 25,000 8,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

Answered By

Daniel Kimutai

I am a competent academic expert who delivers excellent writing content from various subjects that pertain to academics. It includes Electronics engineering, History, Economics, Government, Management, IT, Religion, English, Psychology, Sociology, among others. By using Grammarly and Turnitin tools, I make sure that the writing content is original and delivered in time. For seven years, I have worked as a freelance writer, and many scholars have achieved their career dreams through my assistance.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Prepare a memorandum to the tax manager outlining the information you found in your research. Format the memo to include: Restatement of Facts (paraphrase) Identify at least three main issues based...

-

Find the kinematic viscosity of oil having density 981 kg/m 3 . The shear stress at a point in oi! is 0.2452 N/m 2 and velocity gradient at that point is 0.2 per second.

-

A calendar year S corporation has the following information for the current taxable year: Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

All adiabatic temperature changes occur as a result of a. changes in the absolute humidity of the air. b. expansion or compression of the air. c. changes is specific humidity d. the addition or...

-

What is an experiment?

-

Using the information from BE19-2, assume this is the only difference between Oxfords pretax financial income and taxable income. Prepare the journal entry to record the income tax expense, deferred...

-

What information must an enterprise report by geographic area? LO3

-

1. To what extent do the three people featured in this case study manage their own emotions on the job? How do they accomplish this? To what extent do you think they effectively manage emotions under...

-

What is the difference in the three methods of depreciating plant assets? Do the different methods calculate different depreciation amounts per year and in total? What is book value and will book...

-

Aubrey Corporation changes from a regular C corporation in 2018 to an S corporation as of the beginning of 2019. For 2019, the corporation has $40,000 of built-in gain and $45,000 in accounting...

-

Acme Corporation, a calendar year S corporation, has $100,000 of Accumulated Earnings and Profits. Larry, the sole shareholder, has adjusted basis of $80,000 in stock basis with a $20,000 in...

-

The polarization in all of space has the form P = P(r R)r, where P and R are constants. Find the polarization charge density and the electric field everywhere.

-

Winston Electronics reported the following information at its annual meetings. The company had cash and marketable securities worth $1,235,740, accounts payables worth $4,160,391, inventory of...

-

Hooray Company has been manufacturing 12,000 units of Part A which is used to manufacture one of its products. At this level of production, the cost per unit is as follows: Direct materials P 4.80...

-

At the beginning of the period, the Grinding Department budgeted direct labor of $171,200 and property tax of $57,000 for 10,700 hours of production. The department actually completed 12,800 hours of...

-

The following information is available for Shamrock Corporation for the year ended December 31, 2025. Beginning cash balance $ 58,500 Accounts payable decrease 4,810 Depreciation expense 210,600...

-

In today's stock market, compounding is the key to making money in the future for one's investments. However, with decentralized currency growing rapidly (Crypto), how can one rely on TVM for FV...

-

What benefit is the conceptual framework project to the FASB if (a) there is no way of determining optimal accounting regulation and (b) regulatory decision making is a political process?

-

Given that all the choices are true, which one concludes the paragraph with a precise and detailed description that relates to the main topic of the essay? A. NO CHANGE B. Decades, X-ray C. Decades...

-

Phil, age 30, is married and files a joint return with his spouse. On February 15, 2018, Phil establishes a traditional IRA for himself and a spousal IRA for his spouse with a $11,000 contribution,...

-

In 2017, Julie, a single individual, reported the following items of income and deduction: Salary $166,000 Interest income 14,000 Long-term capital gain from sales of stock 22,000 Short-term...

-

Jerry sprayed all of the landscaping around his house with a pesticide in June 2017. Shortly thereafter, all of the trees and shrubs unaccountably died. The FMV and the adjusted basis of the plants...

-

thumbs up if correct A stock paying no dividends is priced at $154. Over the next 3-months you expect the stock torpeither be up 10% or down 10%. The risk-free rate is 1% per annum compounded...

-

Question 17 2 pts Activities between affiliated entities, such as a company and its management, must be disclosed in the financial statements of a corporation as O significant relationships O segment...

-

Marchetti Company, a U.S.-based importer of wines and spirits, placed an order with a French supplier for 1,000 cases of wine at a price of 200 euros per case. The total purchase price is 200,000...

Study smarter with the SolutionInn App