Barbara Bliss had the following recognized gains and losses during 2019: What are the net tax consequences

Question:

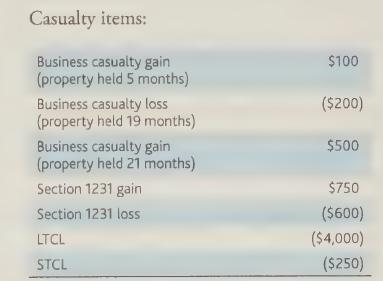

Barbara Bliss had the following recognized gains and losses during 2019:

What are the net tax consequences of these gains and losses for Barbara?

Barbara's adjusted gross income is $30,000 without considering the above items.

Transcribed Image Text:

Casualty items: Business casualty gain (property held 5 months) Business casualty loss (property held 19 months) Business casualty gain (property held 21 months) Section 1231 gain Section 1231 loss LTCL STCL $100 ($200) $500 $750 ($600) ($4,000) ($250)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

Based on the information providedBarbaras net tax consequences for 2019 would be as follows Total ...View the full answer

Answered By

Hassan Ali

I am an electrical engineer with Master in Management (Engineering). I have been teaching for more than 10years and still helping a a lot of students online and in person. In addition to that, I not only have theoretical experience but also have practical experience by working on different managerial positions in different companies. Now I am running my own company successfully which I launched in 2019. I can provide complete guidance in the following fields. System engineering management, research and lab reports, power transmission, utilisation and distribution, generators and motors, organizational behaviour, essay writing, general management, digital system design, control system, business and leadership.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Andrew Graham had the following recognized gains and losses during 2019: What are the net tax consequences of these gains and losses to Andrew? Andrews adjusted gross income is $40,000 without...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Which form of business organization is limited by the Internal Revenue Code (IC) concerning the number and type of shareholders? A partnership An S corporation A C corporation A sole proprietorship...

-

You are the manager of a local coffee shop. There are two types of customers in your market, coffee addicts, and casual drinkers. Because coffee addicts buy large amounts of coffee, they are more...

-

Determine the solution of the following simultaneous equations by Cramer's rule. 2x1 + 4x2 = 20 4x1 - 2x2 = 10

-

Preston Racquets manufactures tennis racquets. The following data are available for last month (Click the icon to view the data) Using variable costing, what is the operating income at Preston...

-

Explain what is meant by a marketing channel of distribution and why intermediaries are needed.

-

For each of the transactions listed in Test Yourself Question 3, what will be the ultimate effect on the money supply if the required reserve ratio is one-eighth (12.5 percent)? Assume that the...

-

You have just been hired as a management trainee by Benjamins Fashions, a nationwide distributor of a designer's silk ties. The company has an exclusive franchise on the distribution of the ties, and...

-

Steven Stronghold had a Section 1231 net gain of $25,000 in 2019. His previous net Section 1231 items were $12,000 in 2012, ($8,000) in 2013, ($6,000) in 2014, ($3,000) in 2015, ($1,000) in 2016,...

-

Kirk Kelley, a single taxpayer, was engaged in the following transactions in 2019: Kirk lent a friend $2,500; that person did not pay the loan when it was due and then declared bankruptcy. The loan...

-

You draw a single card from a standard 52-card deck. If it is an ace, you win $104. Otherwise you get nothing. What is the expected value of the game to you?

-

Using a ruler and set squares only, construct the following shapes: a. b. c. d. 5cm 5cm

-

The marketing department has just forecast that 10,000 units of item 778 will be ordered in the next fiscal year. Based on the marketing department's forecast and noting that the seasonal relative...

-

Following are interaction plots for three data sets. Which data set has the largest interactions? Which has the smallest? A B C

-

From your local chamber of commerce, obtain the population figures for your city for the years \(1980,1990,2000\), and 2010. Find the rate of growth for each period. Forecast the population of your...

-

A mass \(m\) is attached at the midpoint of a stretched wire of area of cross-section \(A\), length \(l\), and Young's modulus \(E\) as shown in Fig. 13.29. If the initial tension in the wire is...

-

A 0.010 M solution of ammonia, NH3, has a pH of 10.6 at 25C. What is the concentration of hydroxide ion?

-

What is an access control list?

-

Should nonprofit organizations be viewed principally as businesses with a social purpose, or are they inherently different from for-profit companies?

-

Should philanthropic foundations change their current focus of funding nonprofit organizations based on the results of the programs provided to one of funding organizations that best demonstrate an...

-

Read Yusuf (Wie) J. & Sloan, M.F. (2015). Effectual Processes in Nonprofit Start-Ups and Social Entrepreneurships: An Illustrated Discussion of a Novel Decision-Making Approach by Juita-Elena (Wie)...

-

7 . 4 3 Buy - side vs . sell - side analysts' earnings forecasts. Refer to the Financial Analysts Journal ( July / August 2 0 0 8 ) study of earnings forecasts of buy - side and sell - side analysts,...

-

Bond P is a premium bond with a coupon of 8.6 percent , a YTM of 7.35 percent, and 15 years to maturity. Bond D is a discount bond with a coupon of 8.6 percent, a YTM of 10.35 percent, and also 15...

-

QUESTION 2 (25 MARKS) The draft financial statements of Sirius Bhd, Vega Bhd, Rigel Bhd and Capella for the year ended 31 December 2018 are as follows: Statement of Profit or Loss for the year ended...

Study smarter with the SolutionInn App