Bill and Alice Savage, husband and wife and both age 42, have the following transactions during 2018:

Question:

Bill and Alice Savage, husband and wife and both age 42, have the following transactions during 2018:

a. They sold their old residence on January 28,2018 , for \(\$ 380,000\). The basis of their old residence, purchased in 2008 , was \(\$ 70,000\). The selling expenses were \(\$ 20,000\). On May 17,2018 , they purchased and moved into another residence costing \(\$ 150,000\).

b. On April 28, 2018, they sold for \(\$ 8,000\) stock that Alice had received as a gift from her mother, who had purchased the stock for \(\$ 10,000\) in 2013. Her mother gave Alice the stock on November 15, 2017, when the fair market value was \(\$ 9,400\).

c. On May 24,2018 , Bill sold for \(\$ 21,000\) stock inherited from his father. His father died on June 14, 2017, when the fair market value of the stock was \(\$ 9,000\). Bill's father paid \(\$ 7,000\) for the stock in 2011.

d. On August 11, 2018, they sold a personal automobile for \(\$ 8,000\); basis of the automobile was \(\$ 20,000\) and it was purchased in 2015.

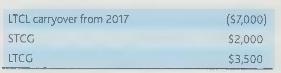

e. They had a carryover and other stock transactions as follows:

Bill had salary of \(\$ 40,000\) and Alice had salary of \(\$ 28,000\). They have no children. They paid state income taxes of \(\$ 6,200\), sales tax of \(\$ 400\), federal income taxes of \(\$ 15,000\), and property taxes of \(\$ 1,700\). In addition, they contributed \(\$ 16,000\) to their church and paid \(\$ 4,000\) interest on their home mortgage.

Compute Bill and Alice's taxable income for 2018.

Step by Step Answer:

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback