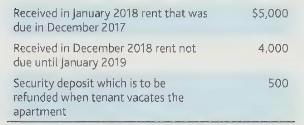

Billy Dent, as the owner of an apartment building, receives and makes the following payments during 2018:

Question:

Billy Dent, as the owner of an apartment building, receives and makes the following payments during 2018:

How much rental income must Billy Dent include on his 2018 income tax return?

Transcribed Image Text:

Received in January 2018 rent that was due in December 2017 Received in December 2018 rent not due until January 2019 Security deposit which is to be refunded when tenant vacates the apartment $5,000 4,000 500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

For tax purposes rental income should generally be reported in the year it is received However there ...View the full answer

Answered By

Morgan Njeri

Very Versatile especially in expressing Ideas in writings.

Passionate on my technical knowledge delivery.

Able to multitask and able to perform under pressure by handling multiple challenges that require time sensitive solution.

Writting articles and video editing.

Revise written materials to meet personal standards and satisfy clients demand.

Help Online Students with their course work.

4.90+

12+ Reviews

38+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

You asked: "25. Billy Dent, as the owner of an apartment building, receives and makes the following payments during 2010 Received in January 2010 rent that was due in December 2009 $5,000 Received in...

-

Billy Dent, as the owner of an apartment building, receives and makes the following payments during 2019: How much rental income must Billy Dent include on his 2019 income tax return? Received in...

-

You, CPA, are the tax partner in your own small accounting firm, You CPA LLP. You have just finished a meeting with two potential clients; Adnan and Hae-Min Ranger. Adnan and Hae-Min are members at...

-

Harpo Marks Corporation produces and sells forklift trucks. Model 17A (the Chico) has a list price of $ 70,000. The production cost for the 20 finished Chicos in inventory at the end of 20X4 was $...

-

Is there such a thing as the correct choice for a class width? Is there such a thing as a poor choice for a class width? Explain your reasoning.

-

Suppose that the current through a resistor is described by the function i ( t ) = (60 - t ) 2 + (60 - t ) sin( t ) and the resistance is a function of the current, R = 12 i + 2 i 2/3 Compute the...

-

5. The simplified governmental fund accounting model is as follows: a Assets Liabilities Fund Balance b Current Assets Current Liabilities Fund Balance c Current Assets Noncurrent Assets ...

-

Why are liability accounts included in the capital acquisition and repayment cycle audited differently from accounts payable?

-

Kurtulus Corporation uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month are listed below: Beginning work in...

-

Abby, a cash basis taxpayer, is paid an annual salary of \(\$ 250,000\) plus a percentage of net profits. The additional compensation for 2018 was \(\$ 50,000\). This sum is payable to her on...

-

Fred Miller, a teacher, had several additional sources of income during 2018. He received a \(\$ 500\) gift as a result of his helping a friend build a house, and he was assigned \(\$ 300\) of...

-

A significant amount of mercury is poured into a U-tube with both ends open to the atmosphere. If water is poured into one leg of the U-tube until the water column is 3 feet above the mercury- water...

-

Units processed during September for material and conversion. Ask an instructor lock lock lock A 3 A copy Determine the cost per equivalent unit for material and conversion cost combined. copy...

-

12% of all college students volunteer their time. Is the percentage of college students who are volunteers different for students receiving financial aid? Of the 338 randomly selected students who...

-

Mervon Company has two operating departments: mixing and bottling. Mixing has 3 3 0 employees and Bottling has 2 2 0 employees. Indirect factory costs include administrative costs of $ 1 8 2 , 0 0 0...

-

XP Ltd. is a manufacturing company with high stock requirements. Management are currently considering their stockholding policy. The following information is available for one stock item, material...

-

Process Costing: weighted average method Required: make a cost of production report in good form. Cost of Production Report-Weighted Average First Dept- Gem Company applies 100% of materials at the...

-

What is the effect of an unexpected cash dividend on (a) a call option price and (b) a put option price?

-

What mass of KBr (in grams) should you use to make 350.0 mL of a 1.30 M KBr solution?

-

George has a service business and wishes to create an S corporation with a June 30 fiscal year. What problems might George encounter in his fiscal-year selection?

-

Assume a partner receives a disproportionate distribution consisting of hot assets from a partnership. Explain who will recognize ordinary income and why.

-

Explain why it is that even when a partnership's only income is tax-exempt income and gains from the sales of long- term capital assets, a partner receiving a guaranteed payment must still classify...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

-

Yard Professionals Incorporated experienced the following events in Year 1, its first year of operation: Performed services for $31,000 cash. Purchased $7,800 of supplies on account. A physical count...

Study smarter with the SolutionInn App