Challenge Partners had the following balance sheets at December 31: On that date, it distributed Property 1

Question:

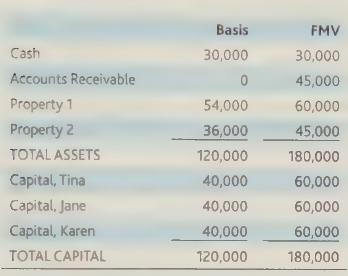

Challenge Partners had the following balance sheets at December 31:

On that date, it distributed Property 1 to Karen in complete liquidation of her interest in the partnership.

a. Will Section 751

(b) apply to this distribution?

b. Will Karen recognize any income or gain in connection with the distribution?

c. What will be Karen's tax basis in Property 1?

Transcribed Image Text:

Cash Accounts Receivable Property 1 Property 2 TOTAL ASSETS Capital, Tina Capital, Jane Capital, Karen TOTAL CAPITAL Basis 30,000 0 54,000 36,000 120,000 40,000 40,000 40,000 120,000 FMV 30,000 45,000 60,000 45,000 180,000 60,000 60,000 60,000 180,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answer a Section 751 of the Internal Revenue Code applies to the sale or exchange of a partnership i...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Consider the facts of problem 49. Assume that rather than property 1, Karen had received the accounts receivable and $15,000 cash in complete liquidation of her interest in the partnership. a. Would...

-

Reconsider the facts in problem 49. Assume the partnership distributed one-third of the accounts receivable and property 2 to Karen in complete liquidation of his interest in the partnership. a. Will...

-

Consider the facts of problem 49. Assume that rather than property 1, Karen had received the accounts receivable and \(\$ 15,000\) cash in complete liquidation of her interest in the partnership. a....

-

Assume an employee signs a non - disparagement clause. What would be considered breaking this clause? a . ) Telling a company's trade secret to a competing firm for a fee b . ) Using a work computer...

-

Refer to the Evolutionary Ecology Research (July 2003) study of the patterns of extinction in the New Zealand bird population, first presented in Exercise 2.24 (p. 42). Again, consider the data on...

-

Discuss the stability of each of these species based on the octet rule and formal charges; . b) H- a) e) -N d) H- -N-C e)

-

Web-based exercise. Oddsmakers often list the odds for certain sporting events on the Web. For example, one can find the current odds of winning the next Super Bowl for each NFL team. We found a list...

-

Feldspar Company uses an ABC system to apply overhead. There are three activity rates, shown on page 243. Setting up ...... $20 per setup Machining ...... $5.10 per machine hour Other overhead ........

-

You purchase a stock at $10.50, and next year it has a price of $20.50, what is the percentage return on this stock? (a) $10.00 (b) 95.24% (c) -48.78% (d) $-10.00

-

Woody is a one-third partner in Boyd Partners. His basis in his partnership interest is $28,000, consisting of his $15,000 capital interest and his $13,000 (one-third) share of partnership...

-

Reconsider the facts of problem 46 above. Assume that Matt received neither properties 2 or 3 from the partnership. Instead, he received property 1, subject to the entire $126,000 partnership...

-

The pH at the equivalence point of the titration of a strong acid with a strong base is 7.0. However, the pH at the equivalence point of the titration of a weak acid with a strong base is above 7.0....

-

A program X running on processor A has a global CPI of 2 and a clock frequency of 2 GHz. The same program X running on processor B has a global CPI of 5 and a clock frequency of 5 GHz. what processor...

-

20 cm Room (3) 20 cm + 1 D=10 cm + 20 cm [ 10 10 cm Figure 7 (d) Using configuration factor formulae given in Figures 7(a), 7(b) and 7(c) Calculate configuration factor F12 in Figure 7(d) treating...

-

2. Let P(3,2,1),Q(2,1,c) and R(c,1,0) be points in R3. (a) Use the cross product definition to find the area of triangle PQR in terms of c. (b) For what values of c (if any) is PQR a right triangle?

-

Find and classify the discontinuities of the following function as removable or nonremovable. If a classification has no discontinuities, write None for your answer. Answer 03023 Hawks Learning A(x)=...

-

Do you see a parallel between the evolution of goals in economics and the move from Corporate Social Responsibility (CSR) to environmental, social, and governance (ESG), ? If so, please explain...

-

Why is discounted cash flow extremely difficult to implement in the accounts?

-

Identify the source of funds within Micro Credit? How does this differ from traditional sources of financing? What internal and external governance mechanisms are in place in Micro Credit?

-

Troy entered into a three-year lease of a luxury automobile on January 1, 2016, for use 80% in business and 20% for personal use. The FMV of the automobile at the inception of the lease was $40,500,...

-

Phillips Corporation, a construction company that specializes in home construction, uses special computer software to schedule jobs and keep track of job costs. It uses generic software for...

-

John and Ellen Brite (SSN 000-00-1111 and 000-00-2222, respectively) are married and file a joint return. They have no dependents. John owns an unincorporated specialty electrical lighting retail...

-

Berbice Inc. has a new project, and you were recruitment to perform their sensitivity analysis based on the estimates of done by their engineering department (there are no taxes): Pessimistic Most...

-

#3) Seven years ago, Crane Corporation issued 20-year bonds that had a $1,000 face value, paid interest annually, and had a coupon rate of 8 percent. If the market rate of interest is 4.0 percent...

-

I have a portfolio of two stocks. The weights are 60% and 40% respectively, the volatilities are both 20%, while the correlation of returns is 100%. The volatility of my portfolio is A. 4% B. 14.4%...

Study smarter with the SolutionInn App