Consider the facts in problem 55 above. Assume that rather than selling his partnership interest to an

Question:

Consider the facts in problem 55 above.

Assume that rather than selling his partnership interest to an outsider, Chris receives a $120,000 cash distribution from the partnership in complete liquidation of his interest therein. How will the consequences differ from those associated with the sale?

Problem 55

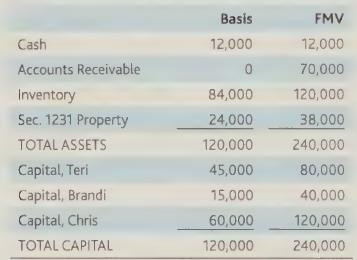

Sowder Partners has the following balance sheets:

Chris has been approached by an unrelated third party with an offer to purchase his interest in the partnership.

a. What is the appropriate selling price for Chris's interest?

b. Assume he agrees to sell his interest for $120,000 cash. How much gain will he recognize on the sale, and what will be its character?

Step by Step Answer:

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback