From the following information determine the total 2018 tax due for Charlene and Dick Storm, assuming they

Question:

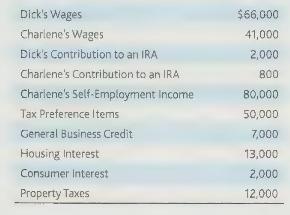

From the following information determine the total 2018 tax due for Charlene and Dick Storm, assuming they file a joint return, have three dependents, and are not members of a qualified retirement plan.

Transcribed Image Text:

Dick's Wages Charlene's Wages Dick's Contribution to an IRA Charlene's Contribution to an IRA Charlene's Self-Employment Income Tax Preference Items General Business Credit Housing Interest Consumer Interest Property Taxes $66,000 41,000 2,000 800 80,000 50,000 7,000 13,000 2,000 12,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

To determine the total 2018 tax due for Charlene and Dick Storm we need to calculate their taxable i...View the full answer

Answered By

Deborah Joseph

My experience has a tutor has helped me with learning and relearning. You learn everyday actually and there are changes that are made to the curriculum every time so being a tutor has helped in keeping me updated about the present curriculum and all.

I have also been able to help over 100 students achieve better grades particularly in the categories of Math and Biology both in their internal examinations and external examinations.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

From the following information determine the total 2019 tax due for Charlene and Dick Storm, assuming they file a joint return, have three dependents, and are not members of a qualified retirement...

-

From the following information determine the total 2020 tax due for Gracelyn and Jason Baxter, assuming they file a joint return, have three dependents all under the age of 8, and are not members of...

-

Roger R. and Michelle N. Stewart (ages 45 and 46) are married and live at 641 Cody Way, Casper, WY 82609. Roger is a consulting engineer, and Michelle is a paralegal. They file a joint return and use...

-

Assignment: Based on your reading and analysis of the case study above, address the following items in a detailed essay response of approximately 600 words. Each number below should be addressed...

-

A golf ball is selected at random from a golf bag. If the golf bag contains 9 Titleists, 8 Maxflis, and 3 Top-Flites, find the probability that the golf ball is: 1. A Titleist or Maxfli. 2. A Maxfli...

-

1. Rob was given a residence in 2010. At the time of the gift, the residence had a fair market value of $200,000, and its adjusted basis to the donor was $140,000. The donor paid a gift tax of...

-

Assume Amy needs to build a data-based case to convince her boss and start to win over Hank. What data should she gather to help her build the case? LO.1

-

A long 1.2 m OD pipeline carrying oil is to be installed in Alaska. To prevent the oil from becoming too viscous for pumping, the pipeline is buried 3 m below ground. The oil is also heated...

-

Dald Idule FSI Fine Sports (FS) operates a megastore featuring sports merchandise. It uses an EOQ decision model to make inventory decisions. It is now considering inventory decisions for its Los...

-

An asset is purchased on May 15, 2014, for \(\$ 100,000\). The full 10 percent investment credit of \(\$ 10,000\) is taken on the asset. On June 23, 2018, a Code Sec. 108 election is made to exclude...

-

Comprehensive Problem. Determine the tax due, including the alternative minimum tax, for Patty Perkins, assuming she is single using the following tax information: Adjusted Gross Income Itemized...

-

A company has a normal production level of 40,000 units per year and production that is more than +/10% from this level is considered abnormal. Fixed overhead costs are $4,000,000. Required: For the...

-

This case study is based on a fictional character on NBC's The Office. Michael is the central character of the series, serving as the Regional Manager of the Scranton branch of a paper distribution...

-

What is the significance of a balance sheet in understanding a firm's financial position? How do changes on the right side of the balance sheet (liabilities and equity) impact a company's financial...

-

A current event analysis where the article must focus on a management concepts). You will read the article and then provide an analysis of the subject matter discussed. The article should complement...

-

Given an exponential distribution with =20, what is the probability that the arrival time is a. less than X=0.2? b. greater than X = 0.2? c. between X=0.2 and X 0.3? d. less than X=0.2 or greater...

-

Choose at least two measures of employee attitudes. Discuss them and tell me about your discussion. Which group you believe are the most effective and efficient measures? Why? 2) Discuss turnover,...

-

A financial institution has just sold 1,000 seven-month European call options on the Japanese yen. Suppose that the spot exchange rate is 0.80 cent per yen, the exercise price is 0.81 cent per yen,...

-

In Problem 8.43, determine the smallest value of for which the rod will not fall out of the pipe. IA -3 in.-

-

Chatham Mae is single, age 35, and ,vanes co make a contribution to an IRA for the year ended December 31, 2018. She is an active participant in a qualified retirement plan sponsored by her employer....

-

Jack and Katie have five grandchildren, ages 19, 16, 15, 12, and 10. They have established Coverdell Education Savings Accounts (CESA) for each of the grandchildren and would like co contribute the...

-

Stock Options. Bell Corporation grants an incentive stock option to Peggy, an employee, on January 1, 2018, when the option price and FMV of the Bell stock is $80. The option entitles Peggy to buy 10...

-

Maddox Resources has credit sales of $ 1 8 0 , 0 0 0 yearly with credit terms of net 3 0 days, which is also the average collection period. Maddox does not offer a discount for early payment, so its...

-

Selk Steel Co., which began operations on January 4, 2017, had the following subsequent transactions and events in its long-term investments. 2017 Jan. 5 Selk purchased 50,000 shares (25% of total)...

-

Equipment with a book value of $84,000 and an original cost of $166,000 was sold at a loss of $36,000. Paid $100,000 cash for a new truck. Sold land costing $330,000 for $415,000 cash, yielding a...

Study smarter with the SolutionInn App