Given the following information, determine the taxable portion and return of capital in each situation, as well

Question:

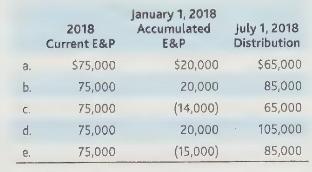

Given the following information, determine the taxable portion and return of capital in each situation, as well as accumulated E\&P on January 1, 2019.

Transcribed Image Text:

a. b. C. d. e. 2018 Current E&P $75,000 75,000 75,000 75,000 75,000 January 1, 2018 Accumulated E&P $20,000 20,000 (14,000) 20,000 (15,000) July 1, 2018 Distribution $65,000 85,000 65,000 105,000 85,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

To determine the taxable portion and return of capital for each situation as well as the accumulated ...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Given the following information, determine the taxable portion and return of capital in each situation, as well as accumulated E&P on January 1, 2020. 2019 Current E&P a. $75,000 b. 75,000 75,000...

-

Ques 1: What is the major complaint by firms concerning the Sarbanes-Oxley act of 2012? A. the legislative maximum allowable compensation for a CEO. B. the legal requirement to disclose project...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Lauren Smith was relaxing after work with a colleague at a local bar. After a few drinks, she began expressing her feelings about her company's new control initiatives. It seems that as a result of...

-

The manufacturer of processed deli meats reports that the standard deviation of the number of carbohydrates in its smoked turkey breast is 0.5 gram per 2-ounce serving. A dietitian does not believe...

-

Figure shows three reactors linked by pipes. As indicated, the rate of transfer of chemicals through each pipe is equal to a flows rate (Q, with units of cubic meters per second) multiplied by the...

-

5. Using the reorganized financial statements created in Question 4,what is the free cash flow for HealthCo in the current year and next year?

-

The partners in Tallis Company decide to liquidate the firm when the balance sheet shows the following. The partners share income and loss 5 : 3 : 2. During the process of liquidation, the...

-

Customer return and refund On December 28, 2013. Silverman Ensold $12.500 of merchandise to Beasley Co with terms 10, W30. The cost of the goods sold was $10.500 on December 31, 2017 Silverman...

-

Genesis Inc. was formed in 2015. Its current \(\mathrm{E} \& \mathrm{P}\) and distributions to shareholders made each year are listed below. What is Genesis Inc.'s year-end accumulated \(E \& P\)...

-

Following are four "income and expense" items of Flor Inc.: dividend income (a 65\% dividends-received deduction was claimed); tax-exempt municipal bond interest income; NOL carryover; federal income...

-

Prove that the torsion subgroup T of an abelian group G is a normal subgroup of G, and that G / T is torsion free. (See Exercise 22.) Data from Exercise 22 A torsion group is a group all of whose...

-

4. Write short notes on Wiener Filtering.

-

1.Explain Histogram processing

-

2. Explain Spatial Filtering ?

-

3. Explain the Geometric Transformations used in image restoration. 4.Describe homomorphic filtering

-

5.Explain the different Noise Distribution in detail. UNIT I V 1. What is segmentation? 2. Write the applications of segmentation. 3. What are the three types of discontinuity in digital image? 4....

-

The CICA Handbook is available to most post-secondary students through their institutions subscription. Visit edu.knotia.ca to complete this exercise. (You may need to complete this exercise on...

-

What are the before image (BFIM) and after image (AFIM) of a data item? What is the difference between in-place updating and shadowing, with respect to their handling of BFIM and AFIM?

-

Hershel Barker was the president and majority shareholder in Bulldog Inc. He was a cash-basis taxpayer who reported his income on a calendar-year basis. On March 1, 2019, Hershel was killed in a...

-

Explain some tax avoidance techniques that could arise in regard to multiple trusts.

-

Explain when loss carryovers can be taken from a trust's federal income tax return and be used on the trust beneficiaries' individual income tax returns.

-

Berbice Inc. has a new project, and you were recruitment to perform their sensitivity analysis based on the estimates of done by their engineering department (there are no taxes): Pessimistic Most...

-

#3) Seven years ago, Crane Corporation issued 20-year bonds that had a $1,000 face value, paid interest annually, and had a coupon rate of 8 percent. If the market rate of interest is 4.0 percent...

-

I have a portfolio of two stocks. The weights are 60% and 40% respectively, the volatilities are both 20%, while the correlation of returns is 100%. The volatility of my portfolio is A. 4% B. 14.4%...

Study smarter with the SolutionInn App