Harvey and Betty Duran, both age 37, are married with one dependent child. Determine their taxable income

Question:

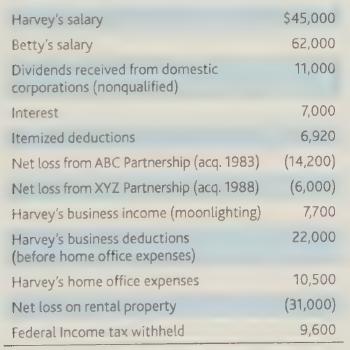

Harvey and Betty Duran, both age 37, are married with one dependent child. Determine their taxable income from the following information for 2018, and their tax liability. Both the ABC and XYZ partnerships are passive activities. Assume dividends are taxed as ordinary income.

Transcribed Image Text:

Harvey's salary Betty's salary Dividends received from domestic corporations (nonqualified) Interest Itemized deductions Net loss from ABC Partnership (acq. 1983) Net loss from XYZ Partnership (acq. 1988) Harvey's business income (moonlighting) Harvey's business deductions (before home office expenses) Harvey's home office expenses Net loss on rental property Federal Income tax withheld $45,000 62,000 11,000 7,000 6,920 (14,200) (6,000) 7,700 22,000 10,500 (31,000) 9,600

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Answer To determine Harvey and Betty Durans taxable income and tax liability for 2018 well first cal...View the full answer

Answered By

Atuga Nichasius

I am a Highly skilled Online Tutor has a Bachelor’s Degree in Engineering as well as seven years of experience tutoring students in high school, bachelors and post graduate levels. I have a solid understanding of all learning styles as well as using asynchronous online platforms for tutoring needs. I individualise tutoring for students according to content tutoring needs assessments.

My strengths include good understanding of all teaching methods and learning styles and I am able to convey material to students in an easy to understand manner. I can also assists students with homework questions and test preparation strategies and I am able to help students in math, gre, business , and statistics

I consider myself to have excellent interpersonal and assessment skills with strong teaching presentation verbal and written communication

I love tutoring. I love doing it. I find it intrinsically satisfying to see the light come on in a student's eyes.

My first math lesson that I taught was when I was 5. My neighbor, still in diapers, kept skipping 4 when counting from 1 to 10. I worked with him until he could get all 10 numbers in a row, and match them up with his fingers.

My students drastically improve under my tutelage, generally seeing a two grade level improvement (F to C, C to A, for example), and all of them get a much clearer understanding!

I am committed to helping my students get the top grades no matter the cost. I will take extra hours with you, repeat myself a thousand times if I have to and guide you to the best of my ability until you understand the concept that I'm teaching you.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Comprehensive Problem (Tax Return Problem). Harvey and Betty Duran, both age 37 , are married with one dependent child. Determine their taxable income from the following information for 2017, and...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Ralph and Kathy Gump are married with one 20-year-old dependent child. Ralph earns a total of $98,000 and estimates their itemized deductions to be $28,500 for the year. Kathy is not employed. Use...

-

Question 1 of 5 Which statement best illustrates Crusoe's reasons for teaching Friday about his religion? OA. He does not see Friday as a savage but as a soul worthy of saving. B. He thinks Friday...

-

Explorer Company manufactures two products, hard-tops and covers for its convertible vehicles. Data for each follows: Hard-top Covers Direct labor hours required per unit 4 8 Contribution margin per...

-

Repeat Example 7.7 for a more compact tube bank in which the longitudinal and transverse pitches are SL = ST = 20.5 mm. All other conditions remain the same.

-

Products must be adapted to accommodate national differences arising from customer preferences and each markets economic conditions, climate, culture, and language. Think about the following...

-

Holmes Company reported the following balance sheets at December 31, 2017 and 2018: Its income statement for 2018 was as follows: ($ in millions)...

-

How do auditors assess the risk of material misstatement in financial statements?

-

Michael Rambo, single and calendar year taxpayer, is the sole owner of Slice-It Pizza Company, a sole proprietorship. Michael materially participated in the activity. In 2019, Slice-It Pizza reported...

-

John Henderson's portable sawmill was completely destroyed by a fire and he carried no insurance on the property. The adjusted basis for depreciation oft he sawmill building and equipment at the time...

-

The ledger of Peter Sato and May Koening, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on December 31, 2008: The balance in Koening's capital...

-

While sovling y' = Ky(Ay), we used the fact that 1 y(1) 1 1 - y y-A Use partial fraction decomposition (and a bit of algebra) to show that this is true. 1) Use partial fractions. Do not merely...

-

You are fluent in three languages. In terms of your strengths, this is an example of what? a. Personal brand b. Vocation c. Experience d. Competency

-

Miller Company's contribution format income statement for the most recent month is shown below: Sales (45,000 units) Variable expenses Contribution margin Fixed expenses Net operating income...

-

Find f''(x). f(x) = (x+8) 5 f''(x) =

-

How does the market play into business financials? 2- How do stocks and bonds play into the future of the organization? 3- What is the future value of money and what is it used for? 4- What is a...

-

Instead of relying on local agents, DHL prides itself on having its own staff of more than 300,000 people across the globe. What are the merits and drawbacks of this international staffing approach?

-

A random sample of 10 houses heated with natural gas in a particular area, is selected, and the amount of gas (in therms) used during the month of January is determined for each house. The resulting...

-

a. Keith Thomas and Thomas Brooks began a new consulting business on January 1, 2017. They organized the business as a C corporation, KT, Inc. During 2017, the corporation was successful and...

-

In 2016, Paul, who is single, has a comfortable salary from his job as well as income from his investment portfolio. However, he is habitually late in filing his federal income tax return. He did not...

-

Which of the following individuals is most likely to be audited? a. Connie has a $20,000 net loss from her unincorporated business (a cattle ranch). She also received a $200,000 salary as an...

-

ABC Corporation has an activity - based costing system with three activity cost pools - Machining, Setting Up , and Other. The company's overhead costs, which consist of equipment depreciation and...

-

Consolidated Balance Sheets - USD ( $ ) $ in Thousands Dec. 3 1 , 2 0 2 3 Dec. 3 1 , 2 0 2 2 Current assets: Cash and cash equivalents $ 9 8 , 5 0 0 $ 6 3 , 7 6 9 Restricted cash 2 , 5 3 2 Short -...

-

How does corporate governance contribute to investor confidence and stakeholder trust? Accounting

Study smarter with the SolutionInn App