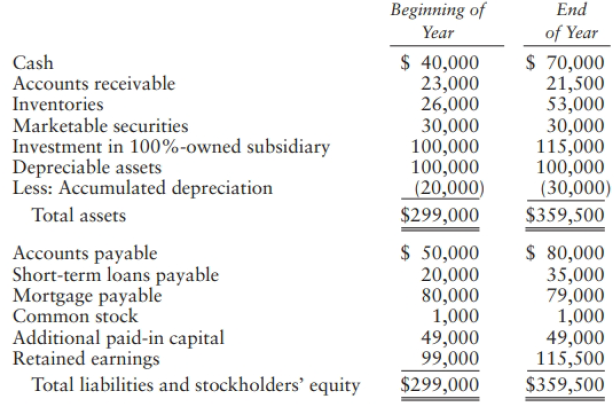

Huge Corporation reports the follo,ving balance sheet for the current year: Huge reports the following income and

Question:

Huge Corporation reports the follo,ving balance sheet for the current year:

Huge reports the following income and expenses for the year:

Sales |

$720,000 |

Purchases |

570,000 |

Dividend from 100%-owned subsidiary |

30,000 |

Dividend from less-than-20%-owned corporation |

10,000 |

Salaries (including officers' salaries of $30,000) |

90,000 |

Repairs |

12,000 |

Contributions |

60,000 |

State and local taxes |

7,500 |

Interest expense |

11,000 |

Financial accounting depreciation |

10,000 |

MACRS depreciation |

17,490 |

Federal income tax expense per books |

10,000 |

In addition, Huge reported an NOL carryover of $12,000 from the preceding year and paid current year estimated taxes of $10,000.Prepare a current year Form 1120 (U.S. Corporation Income Tax Return) for Huge.Leave spaces blank on Form 1120 for information not provided. Note: You should prepare a schedule of net income per books to complete Line 1 of Schedule M-1.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Federal Taxation 2019 Individuals

ISBN: 9780134739670

32nd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson