If Doria Oliva dies this year (2019), what estate tax is payable if the facts are: Adjusted

Question:

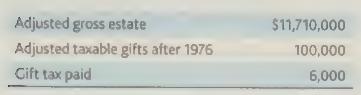

If Doria Oliva dies this year (2019), what estate tax is payable if the facts are:

Transcribed Image Text:

Adjusted gross estate Adjusted taxable gifts after 1976 Cift tax paid $11,710,000 100,000 6,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Answer To calculate the estate tax payable for Doria Olivas estate in 2019 we need to determine ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

The GASB has identified four classes of non-exchange revenues: Derived tax Imposed Government mandated Voluntary For each of the following revenue transactions affecting a city, identify the...

-

Meghan, age 39, and Harry, age 37, are US citizens who were married in May 2018. They live together in California with their two-year old son, Archie, and provide all of his support. Meghan and Harry...

-

1. Hannah is applying for a life policy on her girlfriend Sarahs life. The policy is $500,000 and carries a large premium. Hannah is the main earner, so she is concerned about not being able to pay...

-

The general term that refers to the tendency of a parcel of air to either remain in place or change its initial position is ________. a. adiabatic b. conditional instability c. stasis d. stability

-

An article published in BMC Public Health (Vol. 10, 2010) studied the effectiveness of gold kiwifruit as an iron supplement in women with an iron deficiency. Fifty women were assigned to receive an...

-

Ferraro, Inc. established a stock-appreciation rights (SAR) program on January 1, 2010, which entitles executives to receive cash at the date of exercise for the difference between the market price...

-

How does the consolidation process tend to disguise information needed to analyze the financial operations of a diversified organization? LO3

-

Hector Francisco is a successful businessman in Atlanta. The box-manufacturing firm he and his wife, Judy, founded several years ago has prospered. Because he is self employed, Hector is building his...

-

A recycled plastic cutlery company has overheads of 960398. The company produces two products: knives and forks. The company uses traditional absorption costing to allocate overheads to its products...

-

Melinda transferred $500,000 to an irrevocable, inter vivos trust, leaving the income to Elmo, her husband, for his life, and the remainder to their daughter, Ingrid, if she survives her mother. What...

-

What is a direct skip?

-

Aurora National Bank has two service departments, the Human Resources (HR) Department and the Computing Department. The bank has two other departments that directly service customers, the Deposit...

-

FA II: Assignment 1 - COGS & Bank Reconciliation 1. The following data pertains to Home Office Company for the year ended December 31, 2020: Sales (25% were cash sales) during the year Cost of goods...

-

Bramble Stores accepts both its own and national credit cards. During the year, the following selected summary transactions occurred. Jan. 15 20 Feb. 10 15 Made Bramble credit card sales totaling...

-

11. Korina Company manufactures products S and T from a joint process. The sales value at split-off was P50000 for 6,000 units of Product S and P25,000 for 2,000 units of Product T. Assuming that the...

-

Karak Company produces Product (A) for only domestic distribution since year 2017. In 2019, a similar product to Karak Company has come onto the market by another competitor. Karak Company is keen to...

-

1. Purchase equipment in exchange for cash of $20,400. 2. Provide services to customers and receive cash of $4,900. 3. Pay the current month's rent of $1,000. 4. Purchase office supplies on account...

-

Under financial statement insurance why would the relation between the firm and its auditor and investors bear a slight resemblance to the relationship between Saddam Hussein and the weapons...

-

A line l passes through the points with coordinates (0, 5) and (6, 7). a. Find the gradient of the line. b. Find an equation of the line in the form ax + by + c = 0.

-

On May 1 of the current year, Tara sells a building to Janet for $500,000. Taras basis in the building is $300,000. The county in which the building is located has a real property tax year that ends...

-

On January 1 of the current year, Scott borrows $80,000, pledging the assets of his business as collateral. He immediately deposits the money in an interest-bearing checking account. Scott already...

-

During the current year, Travis takes out a $40,000 loan, using stock he owns as collateral. He uses $10,000 to purchase a car, which he uses 100% for personal use. He uses the remaining funds to...

-

Justice Corporation Comparative Balance Sheet December 31, 2025 and 2024 2025 2024 Assets Current Assets: $ Cash and Cash Equivalents 2,254 $ 1,876 Justice Corporation reported the following...

-

The Fields Company has two manufacturing departments forming and painting. The company uses the FIFO method of process costing at the beginning of the month the forming department has 33.000 units in...

-

A comparative balance sheet for Lomax Company containing data for the last two years is as follows: Lomax Company Comparative Balance Sheet This Year Last Year $ 96,000 $ 70,000 640,000 672,500...

Study smarter with the SolutionInn App