Jen Company decided to change its method of accounting from the cash basis to the accrual basis

Question:

Jen Company decided to change its method of accounting from the cash basis to the accrual basis in 2019. Its taxable income for 2019 under the accrual basis was $250,000.

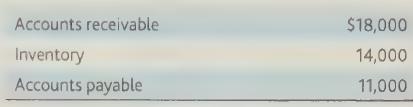

It determined that the balances of accounts receivable, inventory, and accounts payable as of December 2018 were:

a. What is Jen Company’s required adjustment due to the change in accounting methods?

b. What can Jen Company do with the adjustment?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: