Mike and Linda are a married couple who file jointly. They have three dependent children who are

Question:

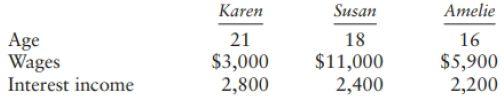

Mike and Linda are a married couple who file jointly. They have three dependent children who are full-time students in 2018. Mike and Linda provided $8,000 of support for each child. Information for each child is as follows:

Compute each child's tax, assuming the interest income is taxable.

Transcribed Image Text:

Karen Amelie Susan 18 Age Wages Interest income 21 16 $3,000 2,800 $11,000 2,400 $5,900| 2,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (12 reviews)

Karen Karens gross tax is 245 At age 21 Karen is subject to the kiddie tax because she is a fulltime ...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2019 Individuals

ISBN: 9780134739670

32nd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax table 3.5. Assume that their taxable income this year was $309,000. Round your...

-

Joe and Jane Keller are a married couple who file a joint income tax return. The couple's taxable income was $102,000. How much federal taxes did they owe? Use the tax tables given in the chapter.

-

Joe and Jane Keller are a married couple who file a joint income tax return, where the tax rates are based on the tax tables presented in the chapter. Assume that their taxable income this year was...

-

MVP Company issued a callable bond. The bond is a 7% semiannual coupon bond currently priced at 102 that has a remaining time to maturity of seven years. The bond is callable beginning the end of...

-

Shot that the product of a rational number (other than 0) and an irrational number is irrational.

-

a. In an arithmetic progression the sum of the first ten terms is 400 and the sum of the next ten terms is 1000. Find the common difference and the first term. b. A geometric progression has first...

-

*Consider the model Yi 0 1xi1 2xi2 i. Show that the matrix V(1 11 (see Equation 9.16 on page 218) for the slope coefficients 1 and 2 contains mean deviation sums of squares and products for the...

-

The journal of Ward Technology Solutions, Inc., includes the following entries for May, 2012: May 1 The business received cash of $75,000 and issued common stock. 2 Purchased supplies of $500 on...

-

Calculate the PW and AW of your 3-year cash flow using interest rate scenarios of 1%, 2%, 3%, 4% and 5%. How would I set up this formula? I just need one PW and AW formula. I can interchange the...

-

ST Inc. and Firm WX are negotiating an exchange of the following business properties: ST agrees to pay $150,000 cash to WX to equalize the value of the exchange. ST's adjusted basis in the office...

-

Jan, a single taxpayer, has adjusted gross income of $250,000, medical expenses of $10,000, home mortgage interest of $3,000, and property taxes of $2,000. Should she itemize or claim the standard...

-

In 2018, Lana, a single taxpayer with AGI of $204,400, claims three dependent children, all under age 17. What is the amount of her child credit?

-

The generalized matching relation has described the choice behavior of: a pigeons b wagtails c rats d all of the above

-

The air in an automobile tire with a volume of \(0.015 \mathrm{~m}^{3}\) is at \(30^{\circ} \mathrm{C}\) and \(140 \mathrm{kPa}\) (gage). Determine the amount of air that must be added to raise the...

-

Convex Productions has just received a contract to film a commercial video that will air during a major sporting event in North America, and then be available on-demand through banner advertisements...

-

The following data (and annotations) for March 2016 are for the work in process account of the first of Olympus Companys four departments used in manufacturing its nly product. Assuming that Olympus...

-

If relative volatility can be assumed constant over the change in concentration for each fraction, Eq. \((9-13)\) can be adapted to the collection of fractions from a simple binary batch...

-

(a) Design a PI controller for Problem 8.6-4(b). (b) Design a PD controller for Problem 8.6-4(c). (c) Use the results of parts (a) and (b) to repeat Problem 8.6-4(d). Problem 8.6-4(b) (c) (d) (b)...

-

Mary Canfield purchased shares in the New Dimensions Global Growth Fund. This fund doesnt charge a front-end load, but it does charge a contingent deferred sales load of 4 percent for any withdrawals...

-

Uniform electric field in Figure a uniform electric field is directed out of the page within a circular region of radius R = 3.00 cm. The magnitude of the electric field is given by E = (4.50 x 10-3...

-

Howard Gartman is a 40% partner in the Horton & Gartman Partnership. During 2015, the partnership reported the total items below (100%) on its Form 1065: Ordinary income .. $180,000 Qualified...

-

In 2014, Paul, who is single, has a comfortable salary from his job as well as income from his investment portfolio. However, he is habitually late in filing his federal income tax return. He did not...

-

Which of the following individuals is most likely to be audited? a. Connie has a $20,000 net loss from her unincorporated business (a cattle ranch). She also received a $200,000 salary as an...

-

Callaho Inc. began operations on January 1 , 2 0 1 8 . Its adjusted trial balance at December 3 1 , 2 0 1 9 and 2 0 2 0 is shown below. Other information regarding Callaho Inc. and its activities...

-

Required: 1. Complete the following: a. Colnpute the unit product cost under absorption costing. b. What is the company's absorption costing net operating income (loss) for the quarter? c. Reconcile...

-

Bond Valuation with Semiannual Payments Renfro Rentals has issued bonds that have an 8% coupon rate, payable semiannually. The bonds mature in 6 years, have a face value of $1,000, and a yield to...

Study smarter with the SolutionInn App