Molly, whose tax rate is 37%, sells an apartment complex for $4.5 million with 10% of the

Question:

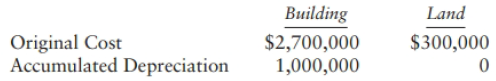

Molly, whose tax rate is 37%, sells an apartment complex for $4.5 million with 10% of the price allocated to land. The apartment complex was purchased in 1993. She has no other sales or exchanges during the year and no nonrecaptured net Sec. 1231 losses. Information about the assets at the time of sale is:

a. What is the recognized gain on the sale of the building and the character of the gain?

b. What is the recognized gain on the sale of the land and the character of the gain?

c. Ho,v much of the Sec. 1231 gain is taxed at 25%?

d. If Molly has NSTCL of $50,000, will the capital loss reduce the Sec. 1231 gain taxed at 25%, or 20%?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2019 Individuals

ISBN: 9780134739670

32nd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson

Question Posted: