On January 1, 2015, Martha Carnes, fresh out of college, contributed ($ 10,000) for a 30 percent

Question:

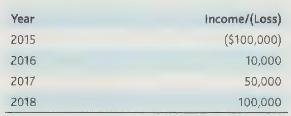

On January 1, 2015, Martha Carnes, fresh out of college, contributed \(\$ 10,000\) for a 30 percent interest in an accounting partnership. The senior partner was not attentive to the work, and the first year they were sued for malpractice and a judgment of \(\$ 100,000\) was entered against the firm. The firm borrowed \(\$ 50,000\) in 2015 to assist in its payment. The debt was repaid in 2017. The following shows the results of the partnership operations:

Compute Martha's reportable income (loss) for each year and the basis of her partnership interest at the end of each year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: