On May 1, 2019, Anthony was in an automobile accident while on his way to work. Following

Question:

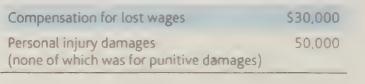

On May 1, 2019, Anthony was in an automobile accident while on his way to work. Following doctor's advice, Anthony stayed home for six months to recover from his injuries. While at home, Anthony filed a lawsuit against the other driver. On December 1, 2019, the lawsuit was settled and Anthony received the following amounts:

How much of the settlement must Anthony include in ordinary income on his 2019 tax return?

Transcribed Image Text:

Compensation for lost wages Personal injury damages (none of which was for punitive damages) $30,000 50,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 20% (5 reviews)

Answer The tax treatment of a lawsuit settlement depends on the nature of the damages awarded In thi...View the full answer

Answered By

Mustafa olang

Please accept my enthusiastic application to solutionInn. I would love the opportunity to be a hardworking, passionate member of your tutoring program. As soon as I read the description of the program, I knew I was a well-qualified candidate for the position.

I have extensive tutoring experience in a variety of fields. I have tutored in English as well as Calculus. I have helped students learn to analyze literature, write essays, understand historical events, and graph parabolas. Your program requires that tutors be able to assist students in multiple subjects, and my experience would allow me to do just that.

You also state in your job posting that you require tutors that can work with students of all ages. As a summer camp counselor, I have experience working with preschool and kindergarten-age students. I have also tutored middle school students in reading, as well as college and high school students. Through these tutoring and counseling positions, I have learned how to best teach each age group. For example, I created songs to teach my three-year-old campers the camp rules, but I gave my college student daily quizzes to help her prepare for exams.

I am passionate about helping students improve in all academic subjects. I still remember my excitement when my calculus student received her first “A” on a quiz! I am confident that my passion and experience are the qualities you are looking for at solutionInn. Thank you so much for your time and consideration.

4.80+

2+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

On May 1, 2018, Anthony was in an automobile accident while on his way to work. Following doctor's advice, Anthony stayed home for six months to recover from his injuries. While at home, Anthony...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Start of Payroll Project 7-3a October 9, 20-- No. 1 The first payroll in October covered the two workweeks that ended on September 26 and October 3. This payroll transaction has been entered for you...

-

Why is an investment portfolio containing a mix of stocks and bonds less risky than one containing a single asset class? Because the markets for stocks and bonds tend to move in the same direction at...

-

Using property she inherited, Myrna makes a 2017 gift of $6.2 million to her adult daughter, Doris. Neither Myrna nor her husband, Greg, have made any prior taxable gifts. Determine the gift tax...

-

Find the magnitude and direction of the resultant of the two forces shown knowing that 500 P = N and Q = 600 N. 40 20 30 15

-

In what ways might an employee experience expatriate assignment failure? LO.1

-

Tamra Corp. makes one product line. In February 2010, Tamra paid $530,000 in factory overhead costs. Of that amount, $124,000 was for Januarys factory utilities and $48,000 was for property taxes on...

-

Mortgage insurance premiums are based on the equity of your home. your mortgage loan balance. the credit history. the amount of your salary or other income.

-

All of the following fringe benefits can be excluded from the employees income except: a. Transportation up to $265 per month for combined commuter highway vehicle transportation and transit passes,...

-

Actress Nola Talent sued her coworker, actor Burt Dirt, for slander, citing his speech at a press interview where he labeled her a "floozy" and an "incompetent excuse for an actress." In her suit she...

-

A \(20 \%\) discount is offered on a new laptop. How much is the discount if the new laptop originally cost \(\$ 700\) ?

-

What did the NFL do to create much needed visibility for corporate sponsors during the football season when fans were not allowed at games due to the virus?

-

The Haines Corporation shows the following financial data for 20X1 and 20X2: Sales Cost of goods sold Selling & administrative expense Gross profit Operating profit Interest expense Income before...

-

From the trial balance of Hugo's Cleaners , ?prepare the following for August: 1 . ?Income Statement 2 . ?Statement of?owner's equity 3 . ?Balance sheet Trail Balance: Hugo's Cleaners Trial Balance...

-

Below is the change in stock for Dow Jones Index for the month of January through July. In the Monthly Change in Stock, create a formula that you can copy down that will calculate the monthly change...

-

-> 14.8 The following information has been extracted from the books of Nimmo Limited for the year to 31 December 20X9: Profit and Loss Accounts for year to 31 December 20X8 000 20X9 000 Profit before...

-

1. An increase in the economic well-being, quality of life, and general welfare of a nations people is called what? 2. What is the name given to the forced transfer of assets from a company to the...

-

Trade credit from suppliers is a very costly source of funds when discounts are lost. Explain why many firms rely on this source of funds to finance their temporary working capital.

-

Taxpayers who deduct an expense one year but recover it the next year are required to include the recovered amount in gross income. The tax benefit rule provides relief if the original deduction did...

-

George, a wealthy investor, is uncertain whether he should invest in taxable or tax-exempt bonds. What tax and non-tax factors should he consider?

-

Do you agree or disagree with the following statement: A taxpayer should not have to report income when debt is forgiven because the taxpayer receives nothing. Explain.

-

Provide a graph chart or data with sample numbers indicating Valuing Stocks and Bonds?

-

I just need help with part b. It says that the answer is not complete and some are wrong. So can you kindly fix it for me and give me the full answers as it says the answer is "not complete". Thank...

-

What is Coke's average ownership percentage in its equity method investments? Goodwill is 7000 Calculate the firm's current ratio (current assets/current liabilities). Calculate the current ratio...

Study smarter with the SolutionInn App