Phil, a cash-basis taxpayer, sells the following marketable securities, which are capital assets during 2018. Determine whether

Question:

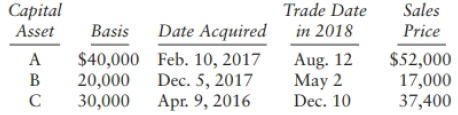

Phil, a cash-basis taxpayer, sells the following marketable securities, which are capital assets during 2018. Determine whether the gains or losses are long-term or short-term. Also determine the net capital gain and adjusted net capital gain for 2018.

Transcribed Image Text:

Sales Price Capital Asset Trade Date Basis Date Acquired in 2018 $40,000 Feb. 10, 2017 Dec. 5, 2017 Aug. 12 May 2 Dec. 10 $52,000 17,000 37,400 A B 20,000 30,000 Apr. 9, 2016

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (16 reviews)

The gain on the sale of A is a LTCG of 12000 the loss on the sa...View the full answer

Answered By

David Muchemi

I am a professional academic writer with considerable experience in writing business and economic related papers. I have been writing for my clients who reach out to me personally after being recommended to me by satisfied clients.

I have the English language prowess, no grammatical and spelling errors can be found in my work. I double-check for such mistakes before submitting my papers.

I deliver finished work within the stipulated time and without fail. I am a good researcher on any topic especially those perceived to be tough.

I am ready to work on your papers and ensure you receive the highest quality you are looking for. Please hire me to offer my readily available quality service.

Best regards,

4.60+

27+ Reviews

61+ Question Solved

Related Book For

Federal Taxation 2019 Individuals

ISBN: 9780134739670

32nd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Donna files as a head of household in 2018 and has taxable income of $110,000, including the sale of a stock held as an investment for two years at a gain of $20,000. Only one asset was sold during...

-

Goal Products Limited (GPL) is the official manufacturer and distributor of soccer balls for the North American League Soccer (NALS), a professional soccer association. GPL is a private company. It...

-

(a) Assume that Blake is a public company and the number of shares held by Blake is enough to give it significant influence over Stergis. Prepare all the journal entries that Blake should make...

-

A functional structure is best suited when a single department has a: dominant interest. surplus of resources. project sponsor. dominant role

-

Show that any rational number p/q, for which the prime factorization of q consists entirely of 2s and 5s, has s terminating decimal expansion.

-

Given that sin = 0.3416 and is in quadrant I, find each of the following using identities. COS 0 2

-

5. (a) Let I be a bounded interval. Prove that if f : I -t R is uniformly continuous on I, then f is bounded on I. (b) Prove that (a) may be false if I is unbounded or if f is merely continuous

-

Information on Canyon Chemicals direct materials costs follows: Quantities of chemical Y purchased and used . . . . . 28,800 gallons Actual cost of chemical Y used . . . . . . . . . . . . . . ....

-

Which of the follwing is true of spouses who have made the election to operate as a QJV (Qualified Joint Venture)? A) They must use the MFS filing status. B) They may combine their income on a joint...

-

Aaron, Deanne, and Keon formed the Blue Bell General Partnership at the beginning of the current year. Aaron and Deanne each contributed $110,000 and Keon transferred an acre of undeveloped land to...

-

Jim inherits stock (a capital asset) from his brother, who died in March of 2018, when the property had a $15.3 million FMV. This property is the only property included in his brother's gross estate...

-

Daniel receives 400 shares of A&M Corporation stock from his aunt on May 20, 2018, as a gift when the stock has a $60,000 FMV. His aunt purchased the stock in 2008 for $42,000. The taxable gift is...

-

Determine each of the following as being either true or false. If it is false, explain the reason why. After using two steps of the Gaussian elimination method for solving the system we would have 2x...

-

The equation for the standard normal curve (the normal curve with mean 0 and standard deviation 1) graphs as an exponential curve. Graph this curve, whose equation is \[y=\frac{e^{-x^{2} /...

-

Design an undirected network with N=7 and L=12. Based on how you drew your network, classify it as either fully connected ,random, or scale-free. Justify your decision with a short paragraph response.

-

Use the Ch08_AviaCo database shown in Figure P8.35 to work Problems 3546. Modify the MODEL table to add the attribute and insert the values shown in the following table. Table P8.35 Attribute and...

-

The Tip Calculator app does not need a Button to perform its calculations. Reimplement this app to use property listeners to perform the calculations whenever the user modifies the bill amount or...

-

A particle, carrying a positive charge of \(4 \mathrm{nC}\), located at \((5 \mathrm{~cm}, 0)\) on the \(x\)-axis experiences an attractive force of magnitude 115.2 \(\mathrm{N}\) due to an unknown...

-

If $4,323 were withheld during the year and taxes owed were $4,122, would the person owe an additional amount or receive a refund?

-

a) Show that (a, b) := {{a}, {b}} does not satisfy the ordered pair axiom. b) Determine whether each of the following statements is true or false. (Give a reason in each case): (i) {a, b} C (a, b)....

-

John and Georgia are a married couple with two dependent sons. Their salaries total $130,000. They have a capital loss of $8,000 and tax-exempt interest income of $1,000. They paid home mortgage...

-

a. Briefly explain the concept of support. b. If a taxpayer provides 50% or less of another persons support, is it possible for the taxpayer to claim a dependency exemption? Explain. c. Does support...

-

Mike and Linda have three dependent children who are full-time students in 2015. Mike and Lindas taxable income is $180,000 and they provided $8,000 of support for each child. Information for each...

-

American Food Services, Incorporated leased a packaging machine from Barton and Barton Corporation. Barton and Barton completed construction of the machine on January 1 , 2 0 2 4 . The lease...

-

Which of the following statements is true? Financial measures tend to be lag indicators that report on the results of past actions. LA profit center is responsible for generating revenue, but it is...

-

Andretti Company has a single product called a Dak. The company normally produces and sells 8 0 , 0 0 0 Daks each year at a selling price of $ 5 6 per unit. The company s unit costs at this level of...

Study smarter with the SolutionInn App