Rodney and Alice Jones have three small children, ranging in age from 5 to 10. One child

Question:

Rodney and Alice Jones have three small children, ranging in age from 5 to 10. One child is blind and needs special care. Rodney works as an accountant for a large CPA firm and has gross income of $45,000. Alice is a lawyer with a national law firm and earns $48,000. Rodney's parents are quite old, and he and his wife fully support them.

Rodney's employer provides group-term life insurance at twice the employee's annual salary. Rodney is 40 years of age.

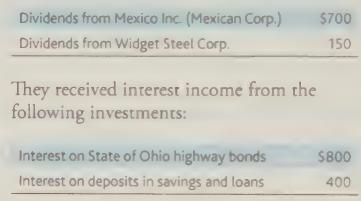

During 2019, Rodney and Alice receive the following dividends on their jointly held investments:

The Joneses have itemized deductions of $25,000. Compute their taxable income.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: