The following information is taken from Lynnso Corporations records for the current year: a. Determine Lynnso Corporation's

Question:

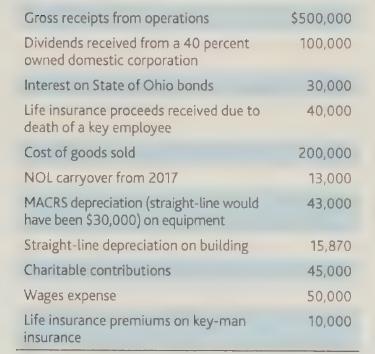

The following information is taken from Lynnso Corporation’s records for the current year:

a. Determine Lynnso Corporation's taxable income.

b. Compute Lynnso Corporation’s current E&P.

Transcribed Image Text:

Gross receipts from operations Dividends received from a 40 percent owned domestic corporation Interest on State of Ohio bonds Life insurance proceeds received due to death of a key employee Cost of goods sold NOL carryover from 2017 MACRS depreciation (straight-line would have been $30,000) on equipment Straight-line depreciation on building Charitable contributions Wages expense Life insurance premiums on key-man insurance $500,000 100,000 30,000 40,000 200,000 13,000 43,000 15,870 45,000 50,000 10,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answer a To determine Lynnso Corporations taxable income we need to start with the gross receipts fr...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

of the 85 caught balls, it was determined that 34 were barehanded catches,49 were caught with a glove , and two were caught with a hat Whaat is the p

-

The following information is taken from Lynnso Corporation's records for 2018 : a. Determine Lynnso Corporation's taxable income for 2018. b. Compute Lynnso Corporation's current E\&P for 2018. Gross...

-

The following information is taken from the records of Wadleys Car Wash for the year ended December 31, 2012. Required: Prepare an income statement for Wadleys Car Wash for the year ended December...

-

Evaluate the integral (4e* + 2 In (2))dx.

-

What are the particular requirements that must be reported in a strategic report?

-

Two charged, parallel, flat conducting surfaces are spaced d = 100 cm apart and produce a potential difference V = 625 V between them. An electron is projected from one surface directly toward the...

-

Lawrence Company ordered parts costing FC100,000 from a foreign supplier on May 12 when the spot rate was $0.20 per FC. A one-month forward contract was signed on that date to purchase FC 100,000 at...

-

Quest Computers, Inc., makes microprocessor chips and personal computers. Its Microprocessor Division makes the chips and supplies them to the Personal Computer Division. The Personal Computer buys...

-

If you own 1 200 shares (4% of a corporation's stock) and the corporation som 12.000 rewares, how many total shares will you have after exercising your promptive in CD A. 1.152 OB. 480 C. 1680 OD 0

-

Flash Co. distributed $40,000 to Skip Inc., a 25 percent shareholder. Flash Co.'s E&P applicable to Skip Inc.s distribution is $20,000 and Skip Inc. had a basis in its stock of $14,000. a. How much...

-

Door Co.'s taxable income was $1,000,000 this year and it paid $210,000 in federal income taxes. Related information for the year follows: $4,000 fines (not deducted to compute taxable income) ...

-

Figure 27.5 and its discussion in the text identify one of the immediate causes of the wealth of nations as human capital. Visit Gapminder World again at Gapminder www.gapminder.org and select...

-

A 10 mm thick steel plate with dimensions of 10 x 10 cm and a density of 7.85 g/cm was submerged in seawater for a period of 1 year. During this period the weight of the plate reduced by 20 grams. Kw...

-

Consider the function f(x1,x2) = x 5x1x2 + 6x at the point x = (0, 2) and search direction p = (1, 1). 1. Write down the first-order Taylor approximation to f(x + ap), where a is the step size. 2....

-

Nike Company has hired a consultant to propose a way to increase the company\'s revenues. The consultant has evaluated two mutually exclusive projects with the following information provided for...

-

What are the most effective way to manage routine and catastrophic disasters, and are they different?

-

The Wall Street Journal reported that of taxpayers with adjusted gross incomes between and itemized deductions on their federal income tax return. The mean amount of deductions for this population of...

-

Why do smaller countries usually get most of the gains from trade?

-

Hotel Majestic is interested in estimating fixed and variable costs so that the company can make more accurate projections of costs and profit. The hotel is in a resort area that is particularly busy...

-

The Hudson Corporations common stock has a beta of 1.13. If the risk-free rate is 4.1 percent and the expected return on the market is 11 percent, what is the companys cost of equity capital?

-

J&R Renovation, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 14 years to maturity that is quoted at 95 percent of face value. The issue makes semiannual...

-

Suspect Corp. issued a 30-year, 5.8 percent semiannual bond seven years ago. The bond currently sells for 104 percent of its face value. The companys tax rate is 35 percent. a. What is the pretax...

-

Famas Llamas has a weighted average cost of capital of 8.8 percent. The companys cost of equity is 12 percent, and its pretax cost of debt is 6.8 percent. The tax rate is 22 percent. What is the...

-

The common stock of a company paid 1.32 in dividens last year. Dividens are expected to gros at an 8 percent annual rate for an indefinite number of years. A) If the company's current market price is...

-

(1 point) Bill makes annual deposits of $1900 to an an IRA earning 5% compounded annually for 14 years. At the end of the 14 years Bil retires. a) What was the value of his IRA at the end of 14...

Study smarter with the SolutionInn App