The Nelson partnership begins business on July 17, 2019. It is not able to use business purpose

Question:

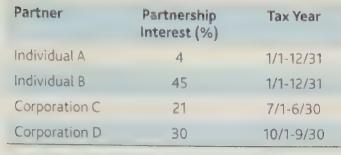

The Nelson partnership begins business on July 17, 2019. It is not able to use business purpose to support a tax year. The four partners, their interests in partnership capital and profits, and their tax years are as follows:

What tax year must the Nelson partnership adopt?

Transcribed Image Text:

Partner Individual A Individual B Corporation C Corporation D Partnership Interest (%) 4 45 21 30 Tax Year 1/1-12/31 1/1-12/31 7/1-6/30 10/1-9/30

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

The tax year for a partnership is typically determined by the tax years of its partners subject to c...View the full answer

Answered By

Jacob Festus

I am a professional Statistician and Project Research writer. I am looking forward to getting mostly statistical work including data management that is analysis, data entry using all the statistical software’s such as R Gui, R Studio, SPSS, STATA, and excel. I also have excellent knowledge of research and essay writing. I have previously worked in other Freelancing sites such as Uvocorp, Essay shark, Bluecorp and finally, decided to join the solution inn team to continue with my explicit work of helping dear clients and students achieve their Academic dreams. I deliver, quality and exceptional projects on time and capable of working under high pressure.

4.90+

1263+ Reviews

2858+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

The Nelson partnership begins business on July 17, 2018. It is not able to use business purpose to support a tax year. The four partners, their interests in partnership capital and profits, and their...

-

Bart, Lisa, and Maggie formed the Kwik-E-Mart LLC at the beginning of 2020. Bart and Lisa each contributed $200,000 and Maggie transferred several acres of agricultural land she had purchased two...

-

MCMPC is facing a unique situation in a market that has evolved significantly. It is in Orange and Sullivan Counties. It faces a significant challenge. How will it compete effectively in a market...

-

Classify the following as microeconomics or macroeconomics and provide a justification for your choice. (i) The effect of changes in household saving rates on the growth rate of national income. (ii)...

-

The separation of aromatic compounds from paraffins is essential in producing many polyesters that are used in a variety of products. When aromatics and paraffins have the same number of carbon...

-

In Figure a horizontal force Fa of magnitude 20.0 N is applied to a 3.00 kg psychology book as the book slides a distance d = 0.500m up a frictionless ramp at angle g = 30.0o. (a) During the...

-

Comparing Automobile Loans. What would be the total vehicle cost in each of these situations? Vehicle 1: A down payment of $3,500 with 48 monthly payments of $312. Vehicle 2: A down payment of $2,700...

-

Is there a difference in how much males and females use aggressive behavior to improve an angry mood? For the "Anger-Out" scores, compare the means for each gender. (a) What is the 95% confidence...

-

9 1 point Owner's equity is the total amount of investment in a business minus the assets. True False Previous 4

-

In 2019 the XYZ Partnership incurred the following expenses: If XYZ began business on August 1, 2019, how much in total of these expenses could XYZ deduct (including amortization)? Expenses of...

-

Ruben and Albert are both calendar-year taxpayers, and are equal partners in the RA Partnership, which has a fiscal year ending on October 31. During the 2019-2020 fiscal year the partnership earns...

-

Using MATLAB, generate the waterfall plot corresponding to Figure 7.23. 0.5 1 Time in seconds N 2.5 2 1.5 3.5 3 0 4 0 5 10 15 Relative distance in meters

-

Match each of the following transactions of Lesch \& Company with the appropriate letters, indicating the debits and credits to be made. The key for the letters follows the list of transactions. The...

-

Workers act as sellers of their time in the labor market in return for some wage. Lets discover your individual supply curve for labor. For each hourly wage rate provided in the accompanying table,...

-

The Joint Commission on Accreditation of Healthcare Organizations (JCAHO) monitors and evaluates health care providers according to strict standards and guidelines. Improvement in the quality of care...

-

The U.S. National Highway Traffic Safety Administratio (NHTSA) independently tests over 2,400 types of tires annually. In 2015, they issued more than 900 recalls, affecting 51 million vehicles...

-

The Hudson Jewelers case study can be found in Appendix C. Chapter 17 Case Questions for Discussion: 1.Research and acquire the criteria for diamond appraisals and critique these criteria in terms of...

-

Iona is a retired school teacher whose pension income is $18,000 per year. She also receives social security income of $12,000 per year. Jay is a young man who does not choose to work. He inherited...

-

President Lee Coone has asked you to continue planning for an integrated corporate NDAS network. Ultimately, this network will link all the offices with the Tampa head office and become the...

-

What inequities might result if partners were not required to make special allocations for precontribution gains and losses on noncash property contributed to a partnership?

-

Indicate whether a partners basis in the partnershipinterest increases, decreases, or is not affected by the partners share of the following operating items: a. Ordinary income b. Ordinary loss c....

-

Phyllis owns a 30% interest in the PQR Partnership and has a $20,000 basis in her partnership interest (before adjustments for Phylliss share of current year partnership income or loss). During the...

-

assume that we have only two following risk assets (stock 1&2) in the market. stock 1 - E(r) = 20%, std 20% stock 2- E(r) = 10%, std 20% the correlation coefficient between stock 1 and 2 is 0. and...

-

Flexible manufacturing places new demands on the management accounting information system and how performance is evaluated. In response, a company should a. institute practices that reduce switching...

-

Revenue and expense items and components of other comprehensive income can be reported in the statement of shareholders' equity using: U.S. GAAP. IFRS. Both U.S. GAAP and IFRS. Neither U.S. GAAP nor...

Study smarter with the SolutionInn App