When does the holding period begin for property acquired through the following transactions? a. Nontaxable exchange b.

Question:

When does the holding period begin for property acquired through the following transactions?

a. Nontaxable exchange

b. Involuntary conversion

Transcribed Image Text:

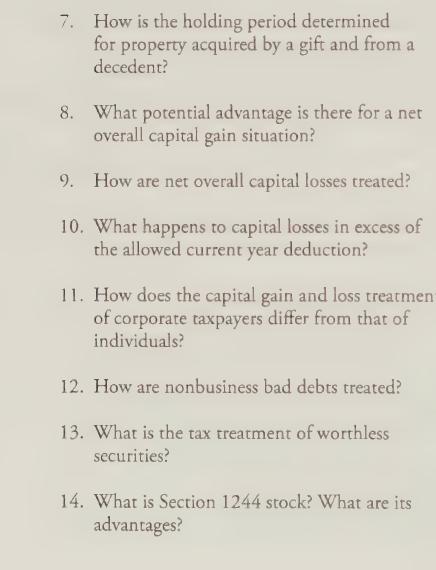

7. How is the holding period determined for property acquired by a gift and from a decedent? 8. What potential advantage is there for a net overall capital gain situation? 9. How are net overall capital losses treated? 10. What happens to capital losses in excess of the allowed current year deduction? 11. How does the capital gain and loss treatmen of corporate taxpayers differ from that of individuals? 12. How are nonbusiness bad debts treated? 13. What is the tax treatment of worthless securities? 14. What is Section 1244 stock? What are its advantages?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

Lets address each question one by one 1 Nontaxable Exchange The holding period for property acquired through a nontaxable exchange like a likekind exchange under Section 1031 generally includes the pe...View the full answer

Answered By

Asd fgh

sadasmdna,smdna,smdna,msdn,masdn,masnd,masnd,m asd.as,dmas,dma.,sd as.dmas.,dma.,s ma.,sdm.,as mda.,smd.,asmd.,asmd.,asmd.,asm

5.00+

1+ Reviews

15+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

In two unrelated transactions, Laura exchanges property that qualifies for like-kind exchange treatment. In the first exchange, Laura gives up land purchased in May 2019 (adjusted basis of $20,000;...

-

When does the holding period begin for replacement property acquired in an involuntary conversion? For property received in a like-kind exchange?

-

Steve Drake sells a rental house on January 1, 2012, and receives $130,000 cash and a note for $55,000 at 10 percent interest. The purchaser also assumes the mortgage on the property of $45,000....

-

In 2020, Neighbor Co-Op Inc. sells 1,100 beverages in glass bottles and receives a $1.00 deposit for each returnable bottle sold. As of December 31, 2020, a total of 880 glass bottles were returned...

-

Describe the process of activation of a CD4 T cell.

-

Nesmith Corporation's outstanding bonds have a $1,000 par value, a 10% semiannual coupon, 12 years to maturity, and a 13% YTM. What is the bond's price Round your answer to the nearest cent. $

-

What challenges does a company that's growing face? LO1

-

Nancy and her daughter, Kathleen, have been working together in a cattery called "The Perfect Cat." Nancy formed the business in 1999 as a sole proprietorship, and it has been very successful. Assets...

-

a. What if it is an existing firm, rather than an entrepreneur, that discovers an idea with a positive NPVwho benefits (financially) from the discovery? Current shareholders? Future shareholders?...

-

What residence-related matter did the Housing Assistance Tax Act of 2008 address?

-

When is fair market value of an asset used as the basis for an asset?

-

Con-Sport Corporation is a regional wholesaler of sporting goods. The systems flowchart in Figure and the following description present Con-Sports cash distribution system. a. The accounts payable...

-

Jimmy Joe-Bob Hicky is the district commander for the mostly-rural Spud Valley highway patrol district in western Idaho. Hes attempting to assign highway patrol cars to different road segments in his...

-

Its important to have a holistic view of all the businesses combined and ensure that the desired levels of risk management and return generation are being pursued. Agree or disagree

-

(3pts each) During a trip to a casino, Adam Horovitz plays his favorite casino game 10 times. Each time he plays, he has a 41% chance of winning. Assume plays of the game are independent. a. What is...

-

An epidemiologist plans to conduct a survey to estimate the percentage of women who give birth. How many women must be surveyed in order to be 95% confident that the estimated percentage is in error...

-

Statement of financial position as at 31 December 2014 ASSETS Non-current assets Property, plant and equipment Delivery van at cost 12,000 Depreciation (2,500) 9,500 Current assets Inventories...

-

How should the sample size be determined for the survey of question 9?

-

To balance the chemical equation SiH3 + O2 SiO2 + HO, you could introduce coefficients a, b, c, d and write aSiH3 + bO2 cSiO + dHO then write linear equations for each element. The equation for Si...

-

Assume the same facts as in Problem 31, except that in January 2019, because of a cost-of-living increase, Don's annuity payment was increased to $ 175 $ 175 per month. Determine the amount of the...

-

Don Smith's wife died in January while still employed and, as her beneficiary, he began receiving an annuity of \(\$ 147\) per month. There was no investment in the contract after June 30,2013 . The...

-

On September 23, 2018, Mary Jones bought an annuity contract for \(\$ 22,050\) that will give her \(\$ 125\) a month for life, beginning October 30. Mary is 61 years old. Determine the exclusion...

-

Series of Compound Interest Techniques The following are several situations involving compound interest. Required: Using the appropriate table, solve each of the following: ( Click here to access the...

-

If Clark Kelly has recognized gain on an exchange of like-kind property held for investment use, where does Clark report the gain? First on Form 8824, then carried to Schedule D. First on Form 8824,...

-

An investor put 40% of her money in Stock A and 60% in Stock B. Stock A has a beta of 1.2 and Stock B has a beta of 1.6. If the risk-free rate is 5% and the expected return on the market is 12%,...

Study smarter with the SolutionInn App