Healthwise Medical Supplies Company is located at 2400 Second Street, City, ST 12345. The company is a

Question:

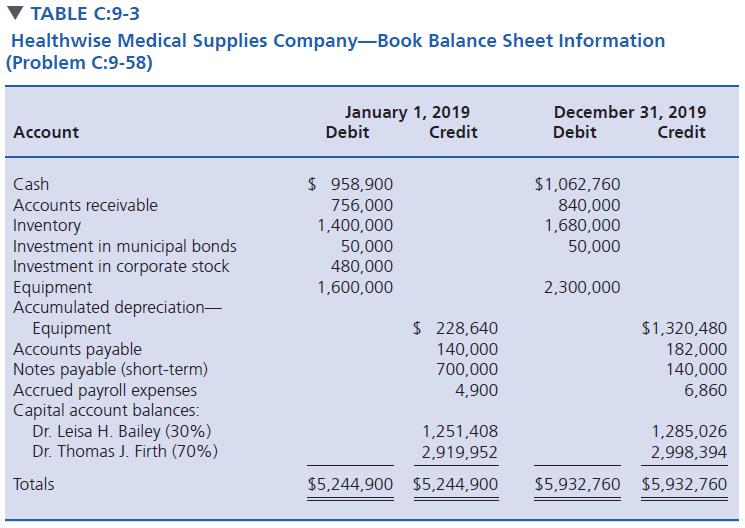

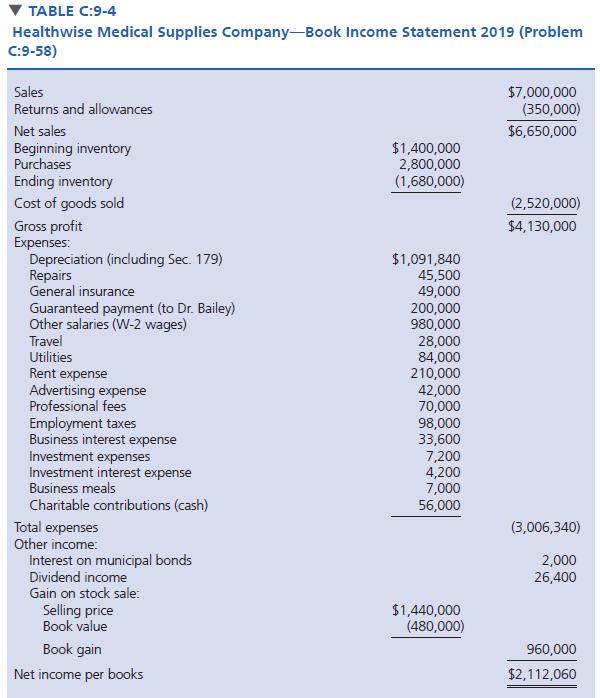

Healthwise Medical Supplies Company is located at 2400 Second Street, City, ST 12345. The company is a general partnership that uses the calendar year and accrual basis for both book and tax purposes. It engages in the development and sale of specialized surgical tools to hospitals. The employer identification number (EIN) is XX-2021019. The company formed and began business on January 1, 2018. It has no foreign partners or other foreign dealings. The company is neither a tax shelter nor a publicly traded partnership. The company has made no distributions other than cash, and no changes in ownership have occurred during the current year. Dr. Bailey is the Designated Partnership Representative. The partnership makes no special elections. Table C:9-3 contains book balance sheet information at the beginning and end of the current year, and Table C:9-4 presents a book income statement for the current year. Other information follows:

Information on Partnership Formation:

Two individuals formed the partnership on January 1, 2018: Dr. Leisa H. Bailey (1200 First Pike, City, ST 12345) and Dr. Thomas J. Firth (3600 Third Blvd., City, ST 54321). For a 30% interest, Dr. Bailey contributed $1.2 million cash. She is an active general partner who manages the company. For a 70% interest, Dr. Firth contributed $2.32 million cash and 1,000 shares of Fastgrowth, Inc. stock having, at the time of ontribution, a $480,000 fair market value (FMV) and a $96,000 adjusted basis. Dr. Firth is an active general partner who designs and develops new products. For book purposes, the company recorded the contribution of stock at fair market value.

Inventory and Cost of Goods Sold (Form 1125-A):

The company uses the periodic inventory method and prices its inventory using the lower of FIFO cost or market. This method conforms to the company’s financial accounting treatment of inventories. Only beginning inventory, ending inventory, and purchases should be reflected in Schedule A. No other costs or expenses are allocated to cost of goods sold. Assume the company is exempt from the uniform capitalization (UNICAP) rules.

Line 9 (a) . . . . . . . . . . . . . . . Check (ii)

(b)–(d) . . . . . . . . . . . . . . . . . Not applicable

(e) & (f) . . . . . . . . . . . . . . . . . No

Capital Gains and Losses (Schedule D):

The company sold all 1,000 shares of the Fastgrowth, Inc. common stock on July 2, 2019, for $1.44 million. Dr. Firth acquired the stock on January 2, 2016, for $96,000 and contributed the stock to the company on January 1, 2018, when its FMV was $480,000. This transaction was not reported on Form 1099-B.

Fixed Assets and Depreciation (Form 4562):

The company acquired the equipment on January 2, 2018, and placed it in service on that date. The equipment, which originally cost $1.6 million, is MACRS seven-year property. The company did not elect Sec. 179 expensing in the acquisition year and elected out of bonus depreciation. The company claimed the following depreciation on this property:

Year . . . . . . . . . . . . . . Book and Regular Tax Depreciation

2018 . . . . . . . . . . . . . . $228,640

2019 . . . . . . . . . . . . . . 391,840

On March 1, 2019, the company acquired and placed in service additional equipment costing $700,000. The company made the Sec. 179 expensing election for the entire cost of this new equipment. No depreciation or expensing is reported on Schedule A.

Other Information:

• The company paid Dr. Bailey a $200,000 guaranteed payment for her management services.

• The company made a $56,000 cash contribution to Fort Sanders Hospital System on December 1 of the current year.

• During the current year, the company made a $600,000 cash distribution to Dr. Bailey and a $1.4 million cash distribution to Dr. Firth.

• The municipal bonds, acquired in 2018, are general revenue bonds, not private-activity bonds. Assume that no expenses of the company are allocable to the tax-exempt interest generated from the municipal bonds.

• Use book numbers for Schedule L, Schedule M-2, and Line 1 of Schedule M-1. Also use book numbers for Item L of Schedule K-1. (Note: The IRS has delayed reporting tax basis capital accounts until 2020.)

• The partners share liabilities, which are recourse, in the same proportion as their ownership percentages.

Required: Prepare the 2019 partnership tax return (Form 1065), including the following additional schedules and forms: Schedule D, Form 4562, and Schedule K-1. Optional: Prepare a schedule for each partner’s basis in his or her partnership interest. At January 1, 2019, Bailey’s basis was $1,504,878, and Firth’s was $3,127,382.

Step by Step Answer:

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse