P and S Corporations form in Year 1, with S as Ps wholly-owned subsidiary. The corporations immediately

Question:

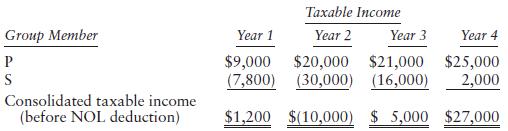

P and S Corporations form in Year 1, with S as P’s wholly-owned subsidiary. The corporations immediately elect to file consolidated tax returns. The group reports the following results:

In what year(s) can the group deduct the Year 2 consolidated NOL? Assume that Year 2 is a post-2017 year.

Transcribed Image Text:

Taxable Income Group Member Year 1 Year 2 Year 3 Year 4 $9,000 $20,000 $21,000 $25,000 (7,800) (30,000) (16,000) P S 2,000 Consolidated taxable income (before NOL deduction) $1,200 $(10,000) $ 5,000 $27,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (6 reviews)

4000 in Year 3 and 6000 in Year 4 Because the NOL arose in a pos...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted:

Students also viewed these Business questions

-

P and S Corporations form in Year 1, with S as Ps wholly-owned subsidiary. The corporations immediately elect to file consolidated tax returns. The group reports the following results: The group does...

-

P and S Corporations have filed consolidated tax returns for ten years. P and S use the accrual method of accounting, and they use the calendar year as their tax year. P and S report separate return...

-

P and S Corporations have filed consolidated tax returns for several years. In Year 1, P purchased land as an investment for $20,000. In Year 3, P sold the land to S for $60,000. S used the land for...

-

World Information Group has two major divisions: print and Internet. Summary financial data (in millions) for 2011 and 2012 are: The annual bonuses of the two division managers are based on division...

-

You have just been hired by General Motors to tour Canada giving randomly selected drivers test rides in a new Corvette (yeah, right). After giving the test drive, you must ask the rider whether he...

-

Does this seem appropriate for the situation the organization is in now?

-

What concept underlies the two-transaction perspective in accounting for foreign currency transactions? LO9

-

Do you believe that Deloitte behaved properly by accepting GMs decision to apply a 6.75 percent discount rate to its pension liabilities? What, if any, other steps or measures should Deloitte have...

-

15 Required: 1. Classify each cost as variable, fixed or mixed (6 marks). You may use columns Dand E in the chart above to assist in answering the question, however, marks will only be awarded for...

-

Sally's Silk Screening produces specialty T-shirts that are primarily sold at special events. She is trying to decide how many toproduce for an upcoming event. During the event itself, which lasts...

-

P Corporation owns all the stock of S1 and S2 Corporations. The corporations have filed consolidated tax returns since their creation in Year 1. At the close of business on July 10 of Year 2, P sells...

-

Peoria and Salem Corporations have filed consolidated tax returns for several years. For the current year, consolidated taxable income is $300,000. The consolidated general business credit (computed...

-

How do trade allowances, performance allowances, and cooperative advertising funds complement each other when implementing a trade promotion plan?

-

What is an incident in which a famous person wore or used a product (not as part of a paid endorsement or ad) and it caused a buying frenzy. Explain how the manufacturer or service provider reacted

-

What is a "heavyweight project team" and how does it differ from the traditional approach used for organizing development projects at Eli Lilly?This consists of two issues:First, an evaluation of the...

-

Consider the closed-loop system shown in Figure P11.6, where the transfer function of the process is that of a second-order system, i.e. k Ts +25TS +1 G,(s)= Y sp(s) E(s) U(s) Y(s) Ge(s) Gp(s) Figure...

-

1. Do you feel we have come along way with inventory in 10 years? 2. How did COVID affect the supply chain in your current hospital? Were any of the inventory systems/topics used, or relevant or...

-

Identify at least one way in which your writing skills have improved this semester and reflect on how you might use this skill in your career. You can include research, presentation, and report...

-

Simplify. 0 (-5)

-

A woman at a point A on the shore of a circular lake with radius 2 mi wants to arrive at the point C diametrically opposite on the other side of the lake in the shortest possible A time. She can walk...

-

John and Kathy Brown have just been audited and the IRS agent disallowed the business loss they claimed in 2016. The agent asserted that the activity was a hobby, nor a business. John and Kathy live...

-

Kelly is self-employed and incurs $2,200 of business meal expense in connection in with business travel. $500 of the business meal cost are considered to be lavish or extravagant. How much can Kelly...

-

Latoya is an independent contractor and operates her own successful consulting business in Milwaukee. She has just signed a large contract with a new client that will require her to spend nine months...

-

How to solve general ledger cash balance chapter 9 assignment 5

-

On 31 July 2018, Sipho bought 1 000 ordinary shares in ABC Ltd at a cost of R2 750. On 31 December 2018 the company made a 1 for 10 bonus issue. On 31 March 2019, Sipho sold 300 shares for R800. What...

-

If you purchase a $1000 par value bond for $1065 that has a 6 3/8% coupon rate and 15 years until maturity, what will be your annual return? 5.5% 5.9% 5.7% 6.1%

Study smarter with the SolutionInn App