Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Robert Smith commenced a tax consultancy service on 1 June 2020. During the first month of operations the following transactions occurred: a. Performed services

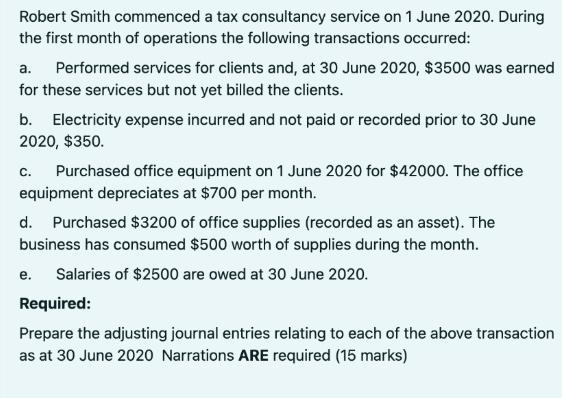

Robert Smith commenced a tax consultancy service on 1 June 2020. During the first month of operations the following transactions occurred: a. Performed services for clients and, at 30 June 2020, $3500 was earned for these services but not yet billed the clients. b. Electricity expense incurred and not paid or recorded prior to 30 June 2020, $350. C. Purchased office equipment on 1 June 2020 for $42000. The office equipment depreciates at $700 per month. d. Purchased $3200 of office supplies (recorded as an asset). The business has consumed $500 worth of supplies during the month. Salaries of $2500 are owed at 30 June 2020. e. Required: Prepare the adjusting journal entries relating to each of the above transaction as at 30 June 2020 Narrations ARE required (15 marks)

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION The adjusting journal entries for Robert Smiths tax consultancy service as at 30 June 2020 are as follows a Accrued revenue DR Accounts recei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started