Assume the same facts as in Problem 1:13-54 except the taxpayer is a corporate taxpayer with a

Question:

Assume the same facts as in Problem 1:13-54 except the taxpayer is a corporate taxpayer with a 21% tax rate and answer the ten true-false questions.

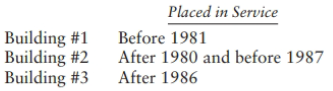

1. Some or all of the gain on sale of #1 is ordinary if accelerated depreciation was used.

2. If the straight-line method of depreciation was used for #1, some or all of the gain may be taxed at 25%.

3. Gain on the sale of #2 could be Sec. 1245 ordinary income.

4. Gain on the sale of #2 could be Sec. 1231 gain.

5. Part of the gain on the sale of #2 could be Sec. 1245 ordinary income and part could be Sec. 1231 gain.

6. If the straight-line method of depreciation was used for #2, some or all of the gain may be taxed at 25%.

7. Some or all of the gain on the sale of #3 could be Sec. 1245 ordinary income.

8. Some or all of the gain on the sale of #3 could be taxed at 25%.

9. Some of the gain on the sale of #3 could be Sec. 1250 ordinary income.

10. If the taxpayer has a nonrecaptured Sec. 12311oss of $30,000 and the gain on the sale of #3 is $40,000, all $40,000 of the gain is taxed as ordinary income.

Step by Step Answer:

Federal Taxation 2019 Comprehensive

ISBN: 9780134833194

32nd Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson