At the close of business on May 31, 2019, Alaska Corporation exchanges $2 million of its voting

Question:

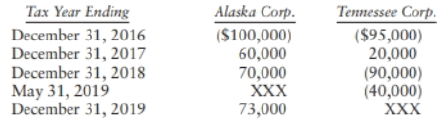

At the close of business on May 31, 2019, Alaska Corporation exchanges $2 million of its voting common stock for all the noncash assets of Tennessee Corporation. Tennessee uses its cash to pay off its liabilities and then liquidates. Tennessee and Alaska report the following taxable income (loss).

a. What tax returns must Alaska and Tennessee file for 2019?

b. What amount of the NOL carryover does Alaska acquire? In your calculation, disregard the 80% of taxable income NOL limitation.

c. Ignoring any implications of Sec. 382, what amount of Tennessee's NOL can Alaska use in 2019?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2020 Comprehensive

ISBN: 9780135196274

33rd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted: