Bobby's marginal tax rate has been low for several years because his sole proprietorship has had low

Question:

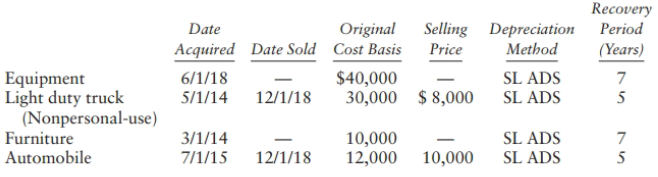

Bobby's marginal tax rate has been low for several years because his sole proprietorship has had low profits. Therefore, he has not elected Sec. 179 expensing, elected out of bonus depreciation, and elected to use the alternative depreciation system for property acquisitions. Bobby acquires, holds, or sells the following assets in 2018:

Assume the half-year convention applies for each year.

a. What is the depreciation deduction for each asset in 2018?

b. What amount of gain or loss does Bobby recognize on the properties sold in 2018?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2019 Comprehensive

ISBN: 9780134833194

32nd Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: