Bonnie's charitable contributions and AGI for the four-year period are as follows: What is the amount of

Question:

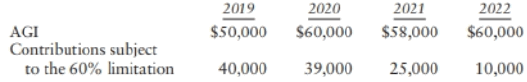

Bonnie's charitable contributions and AGI for the four-year period are as follows:

What is the amount of the charitable deduction for each year and the order in which the deduction and carryovers are used?

Transcribed Image Text:

2019 2020 2021 2022 AGI $50,000 $60,000 $58,000 $60,000 Contributions subject to the 60% limitation 40,000 39,000 25,000 10,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 81% (11 reviews)

2019 2020 2021 2022 Amount of deduction A...View the full answer

Answered By

William Otieno

I am a professional tutor and a writer with excellent skills that are important in serving the bloggers and other specialties that requires a great writer. The important aspects of being the best are that I have served so many clients with excellence

With excellent skills, I have acquired very many recommendations which have made it possible for me to survive as an excellent and cherished writer. Being an excellent content writer am also a reputable IT writer with essential skills that can make one turn papers into excellent result.

4.70+

83+ Reviews

354+ Question Solved

Related Book For

Federal Taxation 2020 Comprehensive

ISBN: 9780135196274

33rd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted:

Students also viewed these Business questions

-

Bonnies charitable contributions and AGI for the past four years were as follows: What is the amount of the charitable deduction for each year and the order in which the deduction and carryovers are...

-

Bonnies charitable contributions and AGI for the past four years were as follows: What is the amount of the charitable deduction for each year and the order in which the deduction and carryovers are...

-

Bonnies charitable contributions and AGI for the past four years were as follows: What is the amount of the charitable deduction for each year and the order in which the deduction and carryovers are...

-

Explain how to determine the maximum or minimum value of a quadratic function.

-

Would this work on your cell phone if it were connected to your computer?

-

Is it possible to successfully map a binary M:N relationship type without requiring a new relation? Why or why not?

-

State four main reasons of charging depreciation.

-

A foreign company maintains its books and records in its domestic currency. Identify several factors that might suggest that the domestic currency is not the entitys functional currency.

-

47. This model assumes that an item will not be re-ordered Fixed quantity model Fixed period model Newsvendor model Price of brake model

-

Input the data from the table into a spreadsheet. Compute the serial correlation in decade returns for each asset class and for inflation. Also find the correlation between the returns of various...

-

During 2019, James, a single, cash method taxpayer incurred the following expenditures: Qualified medical expenses $8,000 Investment interest expense 16,000 Other investment activity expenses 15,000...

-

Qualified Business Income Deduction. Cathy is a 50% partner in the CD partnership, which owns a small manufacturing business. In the current year, the business had qualified business income of $2.8...

-

Balance sheet relations. Selected balance sheet amounts for Anheuser-Busch, a manufacturer of beer and operator of theme parks, for four recent years appear below (amounts in millions): a. Compute...

-

Select an industry that you are interested in, that is in your pathway, and a US company. Do an internet search with the term "sustainability report" and your company name. Once you find a company...

-

You are planning to buy a house in Toronto that has a price of $1,200,000. One of the local banks has offered you a mortgage at a quoted rate of 5% per year. Interest will be compounded semiannually....

-

Identify two significant concepts you have learned from each course You must have at least 6 courses with 12 total concepts. Identify the course in a heading, describe each concept, and explain why...

-

Use Trigonometric Identities to write each expression in terms of a single trigonometric identity or a constant. 1. cot sin 2. 1-sin sin20 1.) 2.) 3. sin 0 sec 0 cos 8 csc 8 cote 3.) Simplify the...

-

Quantitative models and using statistical analysis to evaluate the factors that drive markets, asset classes and individual securities. Would you invest based on a developed model? Why or why not?...

-

What is the output of this program if K = 3? Main Declare K As Integer Input K Set Result = F(K) Write Result End Program Function F(N) As Integer If N == 1 Then Set F = 1 Else Set F = N * F(N-1) Set...

-

Ann hires a nanny to watch her two children while she works at a local hospital. She pays the 19 year-old nanny $125 per week for 48 weeks during the current year. a. What is the employers portion of...

-

Explain how a computer can assist a tax practitioner in tax planning activities and making complex tax calculations.

-

Latesha, a single taxpayer, had the following income and deductions for the tax year 2017: INCOME: Salary $ 80 Business Income 25 Interest income from bonds 10 Tax-exempt bond interest 5 TOTAL INCOME...

-

Most estates are not subject to the federal estate tax. a. Why is this the case? b. Do you believe most estates should be subject to the federal estate tax?

-

What is the value of a 10-year, $1,000 par value bond with a 12% annual coupon if its required return is 11%?

-

September 1 . Purchased a new truck for $ 8 3 , 0 0 0 , paying cash. September 4 . Sold the truck purchased January 9 , Year 2 , for $ 5 3 , 6 0 0 . ( Record depreciation to date for Year 3 for the...

-

Find the NPV for the following project if the firm's WACC is 8%. Make sure to include the negative in your answer if you calculate a negative. it DOES matter for NPV answers

Study smarter with the SolutionInn App