Clark sold securities for a $50,000 short-term capital loss during the current year, but he has no

Question:

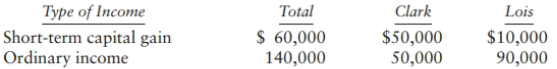

Clark sold securities for a $50,000 short-term capital loss during the current year, but he has no personal capital gains to recognize. The C&L General Partnership, in which Clark has a 50% capita l, profits, and loss interest, reported a $60,000 short-term capital gain this year. In addition, the partnership earned $140,000 of ordinary income. Clark's only partner, Lois, agrees to divide the year's income as follows:

Both partners and the partnership use a calendar year-end, and both partners have a 32% marginal tax rate.

a. Have the partners made a special allocation of income that has substantial economic effect?

b. What amount and character of income must each partner report on his or her tax return?

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Federal Taxation 2019 Comprehensive

ISBN: 9780134833194

32nd Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson