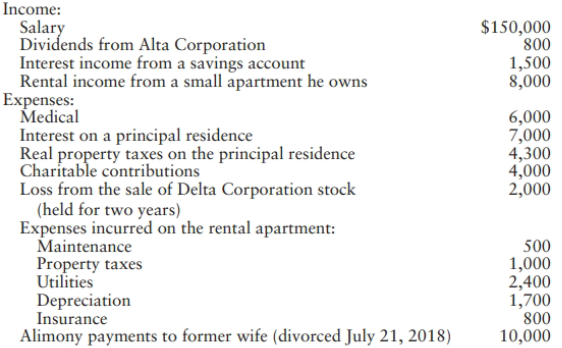

During 2018, Kent, a 40-year-old single taxpayer, reports the following items of income and expense: The amounts

Question:

During 2018, Kent, a 40-year-old single taxpayer, reports the following items of income and expense:

The amounts above are before any limitations. What is Kent's taxable income for the year?

Transcribed Image Text:

Income: Salary Dividends from Alta Corporation Interest income from a savings account Rental income from a small apartment he owns Expenses: Medical Interest on a principal residence Real property taxes on the principal residence Charitable contributions Loss from the sale of Delta Corporation stock (held for two years) Expenses incurred on the rental apartment: Maintenance Property taxes Utilities Depreciation Insurance Alimony payments to former wife (divorced July 21, 2018) $150,000 800 1,500 8,000 6,000 7,000 4,300 4,000 2,000 500 1,000 2,400 1,700 800 10,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 63% (11 reviews)

Kents taxable income is 126600 calculated as follows I...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2019 Comprehensive

ISBN: 9780134833194

32nd Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Bryan and Gayle are equal partners in BG Partnership. The partnership reports the following items of income and expense: Ordinary income from operations $13,000 Interest income 5,000 Long-term...

-

Mario, a single taxpayer with two dependent children, has the following items of income and expense during 2018: Gross receipts from business ............................... $144,000 Business...

-

Anita, a single taxpayer, reports the following items for 2018: Salary...

-

The September 30, 2018, adjusted trial balance of Buzzy?s, Inc., is shown next. Requirements 1. Prepare the September closing entries for Buzzy?s, Inc. 2. Calculate the ending balance in Retained...

-

Show that, if the wait() and signal() semaphore operations are not executed atomically, then mutual exclusion may be violated.

-

Develop a 4-month moving average forecast for Wallace Garden Supply, and compute the MAD. A 3-month moving average forecast was developed in the section on moving averages in Table 5.2.

-

apply the concept of brand equity in sport;

-

Monthly production costs in Dilts Company for two levels of production are as follows. Indicate which costs are variable, fixed, and mixed, and give the reason for eachanswer. Cost 3,000 uits 6,000...

-

[The following information applies to the questions displayed below.] Comparative balance sheets for 2021 and 2020, a statement of income for 2021, and additional information from the accounting...

-

You have $40,000 to invest in Sophie Shoes, a stock selling for $80 a share. The initial margin requirement is 60 percent. Ignoring taxes and commissions, show in detail the impact on your rate of...

-

Sally is an attorney who computes her taxable income using the cash method of accounting. Sage Corporation, owned 40% by Sally's brother, 40% by her cousin, and 20% by her grandmother, uses the...

-

In March 2018, Otter Corporation sends people to the state capital to lobby the legislature to build a proposed highway that is planned to run through the area where its business is located. a . If...

-

In Rolling Stone magazine, several fans and rock stars, including Pearl Jam, were bemoaning the high price of concert tickets. One superstar argued, "It just isn't worth $75 to see me play. No one...

-

2. Ten bars of a certain quality are tested for their diameters. The results are given below. Test the hypothesis at a 95% level of confidence that the mean diameter of the bars produced by the...

-

Write out the state of the list while being sorted using the bubble sort algorithm. 5 8 3 6 9 5 Java code is required.

-

f(x) = 2 X x + 25 X local maximum value local minimum value Need Help? Read It

-

Airbed and Breakfast (428 words): The Startup Story of AirbnbBrian and Joe were flat mates in downtown San Francisco. In mid-2007, IDSA conference crowded downtown, filled all hotel rooms, and drove...

-

# We are testing Null: = 100 against Alternative: 100 using a sample size of 15. The critical values for t for a = .10 are

-

Consider the following generalized geography game wherein the start node is the one with the arrow pointing in from nowhere. Does Player I have a winning strategy? Does Player II? Give reasons for...

-

Solve each equation. x 3 - 6x 2 = -8x

-

Partnerships and S corporations are flow-through entities. In connection with filing annual tax returns, these entities must include Form K-1 in the returns. What is Form K-1, what is its purpose,...

-

The PDQ Partnership earned ordinary income of $150,000 in 2015. The partnership has three equal partners, Pete, Donald, and Quint. Quint, who is single, uses the standard deduction, and has other...

-

Why is a thorough knowledge of sources of tax law so important for a professional person who works in the tax area?

-

Burger King recently launched Real Meals in select markets to deliver an important message about mental health. Real Meals come in five varieties, including a Pissed Meal (for when youre mad) and a...

-

If banks suffer loan losses in excess of their loan-loss-reserves, their Capital Adequacy is unaffected. Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an...

-

The xyz company is considering replacing a current drill press with a new computer-operated model. The protected net operating cash flows for both presses for the next 4 years from today are listed...

Study smarter with the SolutionInn App